Business, 23.09.2019 19:00 snehpatel3356

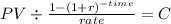

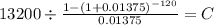

Mary's credit card situation is out of control because she cannot afford to make her monthly payments. she has three credit cards with the following loan balances and aprs: card 1, $4 comma 3004,300, 2121%; card 2, $5 comma 8005,800, 2525%; and card 3, $3 comma 1003,100, 1717%. interest compounds monthly on all loan balances. a credit card loan consolidation company has captured mary's attention by stating they can save mary 2323% per month on her credit card payments. this company charges 16.516.5% apr. is the company's claim correct? assume a 1010-year repayment period.

Answers: 3

Another question on Business

Business, 22.06.2019 17:00

Aaron corporation, which has only one product, has provided the following data concerning its most recent month of operations: selling price $ 102 units in beginning inventory 0 units produced 4,900 units sold 4,260 units in ending inventory 640 variable costs per unit: direct materials $ 20 direct labor $ 41 variable manufacturing overhead $ 5 variable selling and administrative expense $ 4 fixed costs: fixed manufacturing overhead $ 64,200 fixed selling and administrative expense $ 2,900 the total contribution margin for the month under variable costing is:

Answers: 2

Business, 22.06.2019 18:00

During the holiday season, maria's department store works with a contracted employment agency to bring extra workers on board to handle overflow business, and extra duties such as wrapping presents. maria's is using during these rush times.

Answers: 3

Business, 22.06.2019 19:10

Robin hood has hired you as his new strategic consultant to him successfully transform his social change enterprise. robin has told you that he counting on your strategic management knowledge to him and his merrymen achieve their goals. discuss in detail what you think should be robin’s two primary strategic goals and continue by also explaining your analytical reasons that support your recommendations.

Answers: 3

Business, 22.06.2019 19:40

Last year ann arbor corp had $155,000 of assets, $305,000 of sales, $20,000 of net income, and a debt-to-total-assets ratio of 37.5%. the new cfo believes a new computer program will enable it to reduce costs and thus raise net income to $33,000. assets, sales, and the debt ratio would not be affected. by how much would the cost reduction improve the roe? a. 11.51%b. 12.11%c. 12.75%d. 13.42%e. 14.09%

Answers: 3

You know the right answer?

Mary's credit card situation is out of control because she cannot afford to make her monthly payment...

Questions

Social Studies, 28.10.2020 23:50

History, 28.10.2020 23:50

Chemistry, 28.10.2020 23:50

Chemistry, 28.10.2020 23:50

Mathematics, 28.10.2020 23:50

Mathematics, 28.10.2020 23:50

Social Studies, 28.10.2020 23:50

English, 28.10.2020 23:50

Business, 28.10.2020 23:50

Biology, 28.10.2020 23:50

Arts, 28.10.2020 23:50