Business, 23.09.2019 20:30 kenyamaclark1847

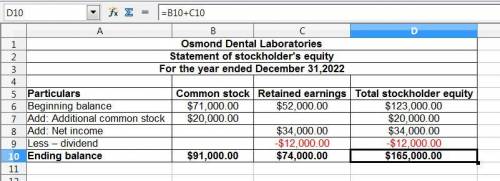

The following is selected financial information for osmond dental laboratories for 2021 and 2022: 2021 2022 retained earnings, january 1 $ 52,000 ? net income 34,000 46,000 dividends 12,000 22,000 common stock 71,000 ? osmond issued 3,000 shares of additional common stock in 2022 for $20,000. there were no other stock transactions. prepare a statement of stockholders' equity for the year ended december 31, 2022. (amounts to be deducted should be indicated with minus sign.)

Answers: 2

Another question on Business

Business, 22.06.2019 04:00

Last week paul, ceo of quality furniture in south carolina, traveled to europe to visit customers. while overseas, paul checked his e-mail daily and showed his company's website to customers, explaining how the website will them place orders and receive merchandise more quickly. after visiting the last customer friday morning, paul was able to return to the corporate office in south carolina to meet with his board of directors that night. is the "shrinking" of time and space with air travel and electronic media.

Answers: 1

Business, 22.06.2019 04:30

Georgia's gross pay was 35,600 this year she is to pay a federal income tax of 16% how much should georgia pay in federal income ax this year

Answers: 1

Business, 22.06.2019 10:00

Suppose an economy has only two sectors: goods and services. each year, goods sells 80% of its outputs to services and keeps the rest, while services sells 62% of its output to goods and retains the rest. find equilibrium prices for the annual outputs of the goods and services sectors that make each sector's income match its expenditures.

Answers: 2

Business, 22.06.2019 14:00

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

You know the right answer?

The following is selected financial information for osmond dental laboratories for 2021 and 2022: 2...

Questions

Mathematics, 19.10.2020 05:01

Health, 19.10.2020 05:01

History, 19.10.2020 05:01

Chemistry, 19.10.2020 05:01

Spanish, 19.10.2020 05:01

Mathematics, 19.10.2020 05:01

Mathematics, 19.10.2020 05:01

Business, 19.10.2020 05:01

English, 19.10.2020 05:01

History, 19.10.2020 05:01

Chemistry, 19.10.2020 05:01

English, 19.10.2020 05:01

English, 19.10.2020 05:01