Business, 26.09.2019 16:30 Wolfb21345

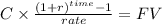

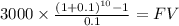

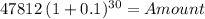

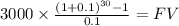

You will get some practice calculating fv and fva's that we learned about in this chapter for this db, while also hopefully showing you something that could you in your personal life! . here try using the future value tables to show yourself the difference that waiting 10 years to start saving for retirement can make. assume you are 27 and start saving $3,000/year. you do this for 10 years before circumstances prevent you from saving any more, but the money that has amassed will continue to sit and earn 10%, like it has from when you first started saving, until you retire at age 67 (another 30 years). so you will first use the fva (future value of an annuity) of $1 chart for $3,000 at 10% for 10 years; then use that resulting number in a fv of $1 chart for 30 years (periods) at 10% to see how much you would have at retirement. next, assume you wait until age 37 to start saving, but no circumstances cause you to stop (a very rare occurrence in real life! unexpected things almost always will happen to derail your best saving so for this one, you will use just the fva chart, still using $3,000 and 10%. show your work and results, as well as comments. are you surprised by the results? i will comment on this later in the week after everyone has posted. original posts should contain a minimum of 120 words.

Answers: 1

Another question on Business

Business, 21.06.2019 14:00

List five words to describe your dominant culture. list five words to describe a culture with which you are not a member, have little or no contact, or have limited knowledge. can someone explain what its meaning?

Answers: 1

Business, 21.06.2019 22:40

wilson's has 10,000 shares of common stock outstanding at a market price of $35 a share. the firm also has a bond issue outstanding with a total face value of $250,000 which is selling for 102 percent of face value. the cost of equity is 11 percent while the preminustax cost of debt is 8 percent. the firm has a beta of 1.1 and a tax rate of 34 percent. what is wilson's weighted average cost of capital?

Answers: 3

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

You know the right answer?

You will get some practice calculating fv and fva's that we learned about in this chapter for this d...

Questions

Spanish, 08.04.2020 22:18

Mathematics, 08.04.2020 22:18

Mathematics, 08.04.2020 22:18

Mathematics, 08.04.2020 22:18

Mathematics, 08.04.2020 22:18

Chemistry, 08.04.2020 22:18

Physics, 08.04.2020 22:18

Social Studies, 08.04.2020 22:18