Adriana company is highly automated and uses computers to control manufacturing operations. the company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of computer-hours. the following estimates were used in preparing the predetermined overhead rate at the beginning of the year:

computer-hours 82,000

fixed manufacturing overhead cost $ 1,278,000

variable manufacturing overhead per computer-hour $ 3.40

during the year, a severe economic recession resulted in cutting back production and a buildup of inventory in the company�s warehouse. the company�s cost records revealed the following actual cost and operating data for the year:

computer-hours 60,000

manufacturing overhead cost $ 1,208,000

inventories at year-end:

raw materials $ 420,000

work in process $ 120,000

finished goods $ 1,030,000

cost of goods sold $ 2,770,000

required:

1.

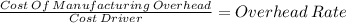

compute the company�s predetermined overhead rate for the year. (round your answer to two decimal places.)

predetermined overhead rate $ per hour

2.

compute the underapplied or overapplied overhead for the year. (input the amount as a positive value. round your predetermined overhead rate calculation to two decimal places. round your final answer to the nearest dollar amount.)

(click to select)overappliedunderapplied overhead cost $

3.1

assume the company closes any underapplied or overapplied overhead directly to cost of goods sold. prepare the appropriate journal entry. (round your predetermined overhead rate calculation to two decimal places. round your final answer to the nearest dollar amount.)

general journal debit credit

(click to select)salaries expensedepreciation expensemanufacturing overheadfinished goodscost of goods soldwork in processraw materialsaccounts payable

(click to select)depreciation expensework in processsalaries expensefinished goodsaccounts payableraw materialsmanufacturing overheadcost of goods sold

3.2

will this entry increase or decrease net operating income?

this entry will increase net operating income.

this entry will decrease net operating income.

Answers: 1

Another question on Business

Business, 22.06.2019 00:40

Eileen's elegant earrings produces pairs of earrings for its mail order catalogue business. each pair is shipped in a separate box. she rents a small room for $150 a week in the downtown business district that serves as her factory. she can hire workers for $275 a week. there are no implicit costs. what is the marginal product of the second worker?

Answers: 3

Business, 22.06.2019 10:30

Factors like the unemployment rate, the stock market, global trade, economic policy, and the economic situation of other countries have no influence on the financial status of individuals. ( t or f)

Answers: 1

Business, 22.06.2019 15:00

Magic realm, inc., has developed a new fantasy board game. the company sold 15,000 games last year at a selling price of $20 per game. fixed expenses associated with the game total $182,000 per year, and variable expenses are $6 per game. production of the game is entrusted to a printing contractor. variable expenses consist mostly of payments to this contractor.required: 1-a. prepare a contribution format income statement for the game last year.1-b. compute the degree of operating leverage.2. management is confident that the company can sell 58,880 games next year (an increase of 12,880 games, or 28%, over last year). given this assumption: a. what is the expected percentage increase in net operating income for next year? b. what is the expected amount of net operating income for next year? (do not prepare an income statement; use the degree of operating leverage to compute your answer.)

Answers: 2

Business, 22.06.2019 19:00

For each of the following cases determine the ending balance in the inventory account. (hint: first, determine the total cost of inventory available for sale. next, subtract the cost of the inventory sold to arrive at the ending balance.)a. jill’s dress shop had a beginning balance in its inventory account of $40,000. during the accounting period jill’s purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. jill’s incurred $1,000 of transportation-in cost and $600 of transportation-out cost. salaries of sales personnel amounted to $31,000. administrative expenses amounted to $35,600. cost of goods sold amounted to $82,300.b. ken’s bait shop had a beginning balance in its inventory account of $8,000. during the accounting period ken’s purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. sales discounts amounted to $640. ken’s incurred $900 of transportation-in cost and $260 of transportation-out cost. selling and administrative cost amounted to $12,300. cost of goods sold amounted to $33,900.a& b. cost of goods avaliable for sale? ending inventory?

Answers: 1

You know the right answer?

Adriana company is highly automated and uses computers to control manufacturing operations. the comp...

Questions

Mathematics, 30.05.2020 09:58

Social Studies, 30.05.2020 09:58

Mathematics, 30.05.2020 09:58

English, 30.05.2020 09:58

Geography, 30.05.2020 09:58

Mathematics, 30.05.2020 09:58

Chemistry, 30.05.2020 09:58

Mathematics, 30.05.2020 09:58