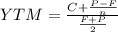

Seven years ago the templeton company issued 21-year bonds with a 12% annual coupon rate at their $1,000 par value. the bonds had a 7% call premium, with 5 years of call protection. today templeton called the bonds. compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. round your answer to two decimal places.

Answers: 2

Another question on Business

Business, 22.06.2019 03:00

Compare the sources of consumer credit 1. consumers use a prearranged loan using special checks 2. consumers use cards with no interest and non -revolving balances 3. consumers pay off debt and credit is automatically renewed 4. consumers take out a loan with a repayment date and have a specific purpose a. travel and entertainment credit b. revolving check credit c. closed-end credit d. revolving credit

Answers: 1

Business, 22.06.2019 13:30

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

Business, 22.06.2019 17:30

Danielle enjoys working as a certified public accountant (cpa) and assisting small businesses and individuals with managing their finances and taxes. which general area of accounting is her specialty? danielle specialized in

Answers: 1

You know the right answer?

Seven years ago the templeton company issued 21-year bonds with a 12% annual coupon rate at their $1...

Questions

Mathematics, 06.06.2021 06:00

Mathematics, 06.06.2021 06:00

Mathematics, 06.06.2021 06:00

Mathematics, 06.06.2021 06:00

History, 06.06.2021 06:00

Mathematics, 06.06.2021 06:00

Chemistry, 06.06.2021 06:00

Mathematics, 06.06.2021 06:00

Biology, 06.06.2021 06:00

Mathematics, 06.06.2021 06:00

Biology, 06.06.2021 06:00