The treasurer of riley coal co. is asked to compute the cost of fixed income securities for her corporation. even before making the calculations, she assumes the aftertax cost of debt is at least 5 percent less than that for preferred stock. debt can be issued at a yield of 8.0 percent, and the corporate tax rate is 25 percent. preferred stock will be priced at $52 and pay a dividend of $5.20. the flotation cost on the preferred stock is $3. a. compute the aftertax cost of debt. (do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.)

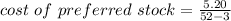

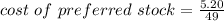

b. compute the aftertax cost of preferred stock. (do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.)

c. based on the facts given above, is the treasurer correct?

Answers: 1

Another question on Business

Business, 21.06.2019 14:40

Easel manufacturing budgeted fixed overhead costs of $ 1.50 per unit at an anticipated production level of 1 comma 350 units. in july easel incurred actual fixed overhead costs of $ 4 comma 700 and actually produced 1 comma 300 units. what is easel's fixed overhead budget variance for july?

Answers: 2

Business, 22.06.2019 11:30

Given the following information about the closed economy of brittania, what is the level of investment spending and private savings, and what is the budget balance? assume there are no government transfers. gdp=$1180.00 million =$510.00 million =$380.00 million =$280.00 million

Answers: 3

Business, 22.06.2019 18:00

1. what is the amount of interest earned after two years on a $100 deposit paying 4 percent simple interest annually? $8.00 $4.08 $8.16 $4.00 2. what is the amount of compound interest earned after three years on a $100 deposit paying 8 percent interest annually? $24.00 $8.00 $16.64 $25.97 3. a business just took out a loan for $100,000 at 10% interest. if the business pays the loan off in three months, how much did the business pay in interest? $2,500.00 $10.00 $250.00 $10,000.00 4. what is the annual percentage yield (apy) for a deposit paying 5 percent interest with monthly compounding? 5.00% 5.12% 79.59% 0.42%

Answers: 1

Business, 22.06.2019 23:10

Amazon inc. does not currently pay a dividend. analysts expect amazon to commence paying annual dividends in three years. the first dividend is expected to be $2 per share. dividends are expected to grow from that point at an annual rate of 4% in perpetuity. investors expect a 12% return from the stock. what should the price of the stock be today?

Answers: 1

You know the right answer?

The treasurer of riley coal co. is asked to compute the cost of fixed income securities for her corp...

Questions

Mathematics, 19.05.2020 20:59

Social Studies, 19.05.2020 20:59

Mathematics, 19.05.2020 20:59

Health, 19.05.2020 20:59

Health, 19.05.2020 20:59

Mathematics, 19.05.2020 20:59

Mathematics, 19.05.2020 20:59

Mathematics, 19.05.2020 20:59