Business, 27.09.2019 01:10 shyshy1791

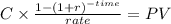

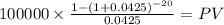

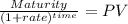

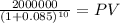

Park corporation is planning to issue bonds with a face value of $2,000,000 and a coupon rate of 10 percent. the bonds mature in 10 years and pay interest semiannually every june 30 and december 31. all of the bonds were sold on january 1 of this year. park uses the effective-interest amortization method and also uses a premium account. assume an annual market rate of interest of 8.5 percent. (fv of $1, pv of $1, fva of $1, and pva of $1) (use the appropriate factor(s) from the tables provided.) required: 1. prepare the journal entry to record the issuance of the bonds

Answers: 1

Another question on Business

Business, 22.06.2019 12:50

There is a small, family-owned store that sells food and household goods in a small town. the owners have good relations with the community, especially with local farmers who supply much of the food. the farmers aren't organized into a cooperative or union, and the store deals with each individually. suppose the store wanted to buy some farms to control the supply of certain vegetables. how would you classify this strategic move? select one: a. horizontal integration b. forward integration c. backward integration d. concentric integration

Answers: 2

Business, 22.06.2019 23:40

John has been working as a tutor for $300 a semester. when the university raises the price it pays tutors to $400, jasmine enters the market and begins tutoring as well. how much does producer surplus rise as a result of this price increase?

Answers: 1

Business, 23.06.2019 01:50

Describe two (2) financial career options that an individual with a finance education might pursue and explain the value that such a position adds to a company. explain the essential skills that would make a person successful in each of the described positions. recommend one (1) of the career options. identify the most attractive features of the position.

Answers: 2

Business, 23.06.2019 02:20

Which one of the following is not a typical current liability? a. interest payable b. current maturities of long-term debt c. salaries payable d. mortgages payable

Answers: 3

You know the right answer?

Park corporation is planning to issue bonds with a face value of $2,000,000 and a coupon rate of 10...

Questions

Computers and Technology, 02.12.2021 19:10

Mathematics, 02.12.2021 19:10

Mathematics, 02.12.2021 19:10

Mathematics, 02.12.2021 19:10

Mathematics, 02.12.2021 19:10

Medicine, 02.12.2021 19:10

English, 02.12.2021 19:10

Chemistry, 02.12.2021 19:10

Computers and Technology, 02.12.2021 19:10

Computers and Technology, 02.12.2021 19:10

History, 02.12.2021 19:10