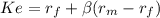

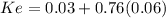

Ashare of stock with a beta of 0.76 now sells for $51. investors expect the stock to pay a year-end dividend of $3. the t-bill rate is 3%, and the market risk premium is 6%. if the stock is perceived to be fairly priced today, what must be investors’ expectation of the price of the stock at the end of the year? (do not round intermediate calculations. round your answer to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 17:20

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 22.06.2019 20:00

A$100 million interest rate swap has a remaining life of 10 months. under the terms of the swap, the six-month libor is exchanged semi-annually for 12% per annum. the six-month libor rate in swaps of all maturities is currently 10% per annum with continuous compounding. the six-month libor rate was 9.6% per annum two months ago. what is the current value of the swap to the party paying floating? what is its value to the party paying fixed?

Answers: 2

Business, 22.06.2019 22:50

Total marketing effort is a term used to describe the critical decision factors that affect demand: price, advertising, distribution, and product quality. define the variable x to represent total marketing effort. a typical model that is used to predict demand as a function of total marketing effort is based on the power function: d = axb suppose that a is a positive number. different model forms result from varying the constant b. sketch the graphs of this model for b = 0, b = 1, 0< b< 1, b< 0, and b> 1. (we encourage you to use excel to do this.) what does each model tell you about the relationship between demand and marketing effort? what assumptions are implied? are they reasonable? how would you go about selecting the appropriate model?

Answers: 1

Business, 22.06.2019 23:10

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

You know the right answer?

Ashare of stock with a beta of 0.76 now sells for $51. investors expect the stock to pay a year-end...

Questions

English, 14.07.2019 18:00

Biology, 14.07.2019 18:00

English, 14.07.2019 18:00

History, 14.07.2019 18:00

Mathematics, 14.07.2019 18:00

Mathematics, 14.07.2019 18:00

English, 14.07.2019 18:00

Mathematics, 14.07.2019 18:00

Geography, 14.07.2019 18:00

Health, 14.07.2019 18:00

Mathematics, 14.07.2019 18:00

Mathematics, 14.07.2019 18:00