Business, 27.09.2019 05:00 anthony4034

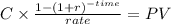

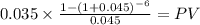

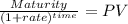

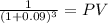

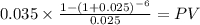

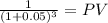

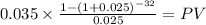

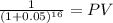

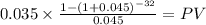

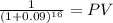

Laurel, inc., and hardy corp. both have 7 percent coupon bonds outstanding, with semiannual interest payments, and both are priced at par value. the laurel, inc., bond has three years to maturity, whereas the hardy corp. bond has 16 years to maturity. if interest rates suddenly rise by 2 percent, what is the percentage change in the price of each bond? if rates were to suddenly fall by 2 percent instead, what would be the percentage change in the price of each bond?

Answers: 1

Another question on Business

Business, 22.06.2019 11:50

The following are the current month's balances for abc financial services, inc. before preparing the trial balance. accounts payable $ 10,000 revenue 6,000 cash 3,000 expenses 17,500 furniture 10,000 accounts receivable 14,000 common stock ? notes payable 6,500 what amount should be shown for common stock on the trial balance? a. $48.000b. $12.500c. $27.000d. $28.000

Answers: 3

Business, 22.06.2019 13:30

Tom has brought $150,000 from his pension to a new job where his employer will match 401(k) contributions dollar for dollar. each year he contributes $3,000. after seven years, how much money would tom have in his 401(k)?

Answers: 3

Business, 22.06.2019 19:00

The market demand curve for a popular teen magazine is given by q = 80 - 10p where p is the magazine price in dollars per issue and q is the weekly magazine circulation in units of 10,000. if the circulation is 400,000 per week at the current price, what is the consumer surplus for a teen reader with maximum willingness to pay of $3 per issue?

Answers: 1

Business, 22.06.2019 19:50

Right medical introduced a new implant that carries a five-year warranty against manufacturer’s defects. based on industry experience with similar product introductions, warranty costs are expected to approximate 2% of sales. sales were $8 million and actual warranty expenditures were $42,750 for the first year of selling the product. what amount (if any) should right report as a liability at the end of the year?

Answers: 2

You know the right answer?

Laurel, inc., and hardy corp. both have 7 percent coupon bonds outstanding, with semiannual interest...

Questions

Mathematics, 10.07.2019 18:00

History, 10.07.2019 18:00

History, 10.07.2019 18:00

Social Studies, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Social Studies, 10.07.2019 18:00

English, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Health, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00

History, 10.07.2019 18:00

Mathematics, 10.07.2019 18:00