Business, 27.09.2019 04:30 IkweWolf4431

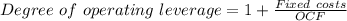

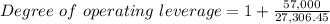

Aproject has an estimated sales price of $71 per unit, variable costs of $44.03 per unit, fixed costs of $57,000, a required return of 14 percent, an initial investment of $79,500, no salvage value, and a life of four years. ignore taxes. what is the degree of operating leverage at the financial break-even level of output?

Answers: 2

Another question on Business

Business, 21.06.2019 14:40

Which website did you use to find the image you used in your career presentation? complete sentences are not necessary.

Answers: 1

Business, 22.06.2019 18:40

Under t, the point (0,2) gets mapped to (3,0). t-1 (x,y) →

Answers: 3

Business, 22.06.2019 19:40

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

Business, 22.06.2019 21:20

Rediger inc., a manufacturing corporation, has provided the following data for the month of june. the balance in the work in process inventory account was $28,000 at the beginning of the month and $20,000 at the end of the month. during the month, the corporation incurred direct materials cost of $56,200 and direct labor cost of $29,800. the actual manufacturing overhead cost incurred was $53,600. the manufacturing overhead cost applied to work in process was $52,200. the cost of goods manufactured for june was:

Answers: 2

You know the right answer?

Aproject has an estimated sales price of $71 per unit, variable costs of $44.03 per unit, fixed cost...

Questions

Mathematics, 02.06.2021 17:50

Chemistry, 02.06.2021 17:50

Mathematics, 02.06.2021 17:50

Mathematics, 02.06.2021 17:50

Mathematics, 02.06.2021 17:50

Mathematics, 02.06.2021 17:50

Mathematics, 02.06.2021 17:50

English, 02.06.2021 17:50

Social Studies, 02.06.2021 17:50

Mathematics, 02.06.2021 17:50

Arts, 02.06.2021 17:50

English, 02.06.2021 17:50

![Initial Investment=OCF(\frac{1-[\frac{1}{(1+r)^{n} }] }{r})](/tpl/images/0266/9342/d6a37.png)

![79,500=OCF(\frac{1-[\frac{1}{(1+0.14)^{4} }] }{0.14})](/tpl/images/0266/9342/d355d.png)