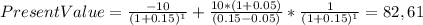

Zhdanov inc. forecasts that its free cash flow in the coming year, i. e., at t = 1, will be -$10 million, but its fcf at t = 2 will be $10 million. after year 2, fcf is expected to grow at a constant rate of 5% forever. if the weighted average cost of capital is 15%, what is the firm’s value of operations, in millions?

Answers: 3

Another question on Business

Business, 21.06.2019 20:30

If delta airlines were to significantly change its fare structure and flight schedule to enhance its competitive position in response to aggressive price cutting by southwest airlines, this would be an example ofanswers: explicit collusion.tacit collusion.competitive dynamics.a harvest strategy.

Answers: 3

Business, 22.06.2019 16:30

Which of the following has the largest impact on opportunity cost

Answers: 2

Business, 23.06.2019 08:00

Using an organization with which you are familiar, identify its corporate culture and the elements of its observable culture. what do you think would need change in order to facilitate innovation? what role would organizational development play in overcoming resistance to change?

Answers: 3

You know the right answer?

Zhdanov inc. forecasts that its free cash flow in the coming year, i. e., at t = 1, will be -$10 mil...

Questions

History, 09.12.2020 17:50

Chemistry, 09.12.2020 17:50

Mathematics, 09.12.2020 17:50

Computers and Technology, 09.12.2020 17:50

Biology, 09.12.2020 17:50

Mathematics, 09.12.2020 17:50