Business, 28.09.2019 03:10 ayoismeisalex

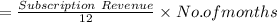

Healthy living, a diet magazine, collected $ 240,000 in subscription revenue on june 30. each subscriber will receive an issue of the magazine in each of the next 12 months, beginning with the july issue. the company uses the accrual method of accounting. what is the amount of subscription revenue that has been earned by the end of december? (round any intermediate calculations to two decimal places, and your final answer to the nearest whole number.)

Answers: 1

Another question on Business

Business, 22.06.2019 08:30

Sonic corp. manufactures ski and snowboarding equipment. it has estimated that this year there will be substantial growth in its sales during the winter months. it approaches the bank for credit. what is the purpose of such credit known as? a. expansion b. inventory building c. debt management d. emergency maintenance

Answers: 3

Business, 22.06.2019 08:40

During january 2018, the following transactions occur: january 1 purchase equipment for $20,600. the company estimates a residual value of $2,600 and a five-year service life. january 4 pay cash on accounts payable, $10,600. january 8 purchase additional inventory on account, $93,900. january 15 receive cash on accounts receivable, $23,100 january 19 pay cash for salaries, $30,900. january 28 pay cash for january utilities, $17,600. january 30 firework sales for january total $231,000. all of these sales are on account. the cost of the units sold is $120,500. the following information is available on january 31, 2018. depreciation on the equipment for the month of january is calculated using the straight-line method. the company estimates future uncollectible accounts. at the end of january, considering the total ending balance of the accounts receivable account as shown on the general ledger tab, $4,100 is now past due (older than 90 days), while the remainder of the balance is current (less than 90 days old). the company estimates that 50% of the past due balance will be uncollectible and only 3% of the current balance will become uncollectible. record the estimated bad debt expense. accrued interest revenue on notes receivable for january. unpaid salaries at the end of january are $33,700. accrued income taxes at the end of january are $10,100

Answers: 2

Business, 22.06.2019 10:50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

You know the right answer?

Healthy living, a diet magazine, collected $ 240,000 in subscription revenue on june 30. each subscr...

Questions

Mathematics, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57

German, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57

History, 10.06.2020 18:57

Social Studies, 10.06.2020 18:57

Health, 10.06.2020 18:57

History, 10.06.2020 18:57

Chemistry, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57

Mathematics, 10.06.2020 18:57