Business, 30.09.2019 20:10 coolasslimm

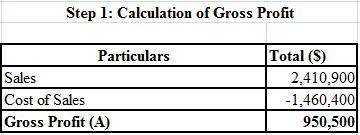

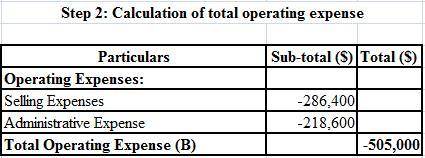

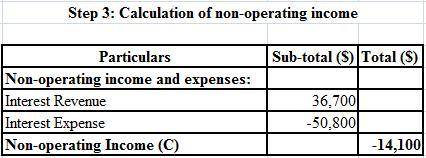

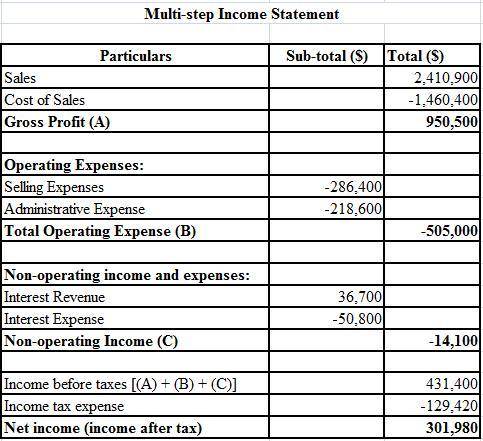

Wildhorse corporation had net sales of $2,410,900 and interest revenue of $36,700 during 2020. expenses for 2020 were cost of goods sold $1,460,400, administrative expenses $218,600, selling expenses $286,400, and interest expense $50,800. wildhorse’s tax rate is 30%. the corporation had 105,200 shares of common stock authorized and 73,090 shares issued and outstanding during 2020. prepare a condensed multiple-step income statement for wildhorse corporation. (round earnings per share to 2 decimal places, e. g. 1.48.)

Answers: 3

Another question on Business

Business, 22.06.2019 05:20

Social computing forces companies to deal with customers as opposed to

Answers: 2

Business, 22.06.2019 06:50

Suppose the marginal damage and marginal benefit curves in a polluted neighborhood are md = p/3 and mb = 4 – p. also, suppose that transactions costs are low, so that the consumers and the firm can bargain. we saw that in this case, the socially-optimal level of pollution is achieved. start by computing the socially-optimal p. then, for each of the following cases, compute the amount of money transferred through the bargaining process, and indicate who pays whom (i.e., whether consumers pay the firm, or vice versa). also, compute the gains to each party relative to the status quo (i.e., the starting point of the bargaining process).a)consumers have the right to clean air; firm is dominant in the bargaining process.b)consumers have the right to clean air; consumers are dominant in the bargaining process.c)firm has the right to pollute; firm is dominant in the bargaining process.d)firm has the right to pollute; consumers are dominant in the bargaining proces

Answers: 1

Business, 22.06.2019 09:30

The 39 percent and 38 percent tax rates both represent what is called a tax "bubble." suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $208,000. what would the new 39 percent bubble rate have to be? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places,e.g., 32.16.)

Answers: 3

Business, 22.06.2019 09:40

Catherine de bourgh has one child, anne, who is 18 years old at the end of the year. anne lived at home for seven months during the year before leaving home to attend state university for the rest of the year. during the year, anne earned $6,000 while working part time. catherine provided 80 percent of anne's support and anne provided the rest. which of the following statements regarding whether anne is catherine's qualifying child for the current year is correct? a.anne is a qualifying child of catherine.b.anne is not a qualifying child of catherine because she fails the gross income test.c.anne is not a qualifying child of catherine because she fails the residence test.d.anne is not a qualifying child of catherine because she fails the support test.

Answers: 2

You know the right answer?

Wildhorse corporation had net sales of $2,410,900 and interest revenue of $36,700 during 2020. expen...

Questions

Mathematics, 21.07.2021 01:30

Mathematics, 21.07.2021 01:30

Advanced Placement (AP), 21.07.2021 01:30

Mathematics, 21.07.2021 01:30

History, 21.07.2021 01:40

Mathematics, 21.07.2021 01:40

Physics, 21.07.2021 01:40

Mathematics, 21.07.2021 01:40

Mathematics, 21.07.2021 01:40

Mathematics, 21.07.2021 01:40