Business, 30.09.2019 20:30 dhernandez081

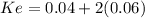

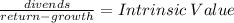

The risk-free rate of return is 4%, the required rate of return on the market is 10%, and high-flyer stock has a beta coefficient of 2.0. if the dividend per share expected during the coming year, d1, is $4.60 and g = 6%, at what price should a share sell? (do not round intermediate calculations. round your answer to 2 decimal places.)

Answers: 3

Another question on Business

Business, 22.06.2019 21:20

Rediger inc., a manufacturing corporation, has provided the following data for the month of june. the balance in the work in process inventory account was $28,000 at the beginning of the month and $20,000 at the end of the month. during the month, the corporation incurred direct materials cost of $56,200 and direct labor cost of $29,800. the actual manufacturing overhead cost incurred was $53,600. the manufacturing overhead cost applied to work in process was $52,200. the cost of goods manufactured for june was:

Answers: 2

Business, 23.06.2019 00:30

Suppose there is a 6 percent increase in the price of good x and a resulting 6 percent decrease in the quantity of x demanded. price elasticity of demand for x is a. 0 b. 6 c. 1 d. 36

Answers: 2

Business, 23.06.2019 11:00

What are the factors that affects on the process of planning

Answers: 3

You know the right answer?

The risk-free rate of return is 4%, the required rate of return on the market is 10%, and high-flyer...

Questions

Social Studies, 17.10.2019 04:50

Geography, 17.10.2019 04:50

Biology, 17.10.2019 04:50

Biology, 17.10.2019 04:50

Mathematics, 17.10.2019 04:50

Social Studies, 17.10.2019 04:50

Geography, 17.10.2019 04:50

History, 17.10.2019 04:50

History, 17.10.2019 04:50

Mathematics, 17.10.2019 04:50