Business, 30.09.2019 22:10 kodarae2501

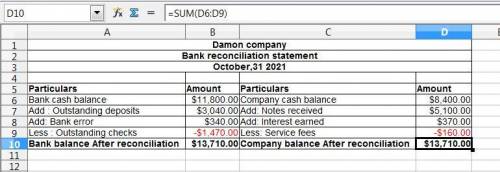

On october 31, 2021, damon company’s general ledger shows a checking account balance of $8,400. the company’s cash receipts for the month total $74,340, of which $71,300 has been deposited in the bank. in addition, the company has written checks for $72,470, of which $71,000 has been processed by the bank. the bank statement reveals an ending balance of $11,800 and includes the following items not yet recorded by damon: bank service fees of $160, note receivable collected by the bank of $5,100, and interest earned on the account balance plus from the note of $370. after closer inspection, damon realizes that the bank incorrectly charged the company’s account $340 for an automatic withdrawal that should have been charged to another customer’s account. the bank agrees to the error. required: 1. prepare a bank reconciliation to calculate the correct ending balance of cash on october 31, 2021. (amounts to be deducted should be indicated with a minus sign.)

Answers: 2

Another question on Business

Business, 22.06.2019 04:30

Annuity payments are assumed to come at the end of each payment period (termed an ordinary annuity). however, an exception occurs when the annuity payments come at the beginning of each period (termed an annuity due). what is the future value of a 13-year annuity of $2,800 per period where payments come at the beginning of each period? the interest rate is 9 percent. use appendix c for an approximate answer, but calculate your final answer using the formula and financial calculator methods. to find the future value of an annuity due when using the appendix tables, add 1 to n and subtract 1 from the tabular value. for example, to find the future value of a $100 payment at the beginning of each period for five periods at 10 percent, go to appendix c for n = 6 and i = 10 percent. look up the value of 7.716 and subtract 1 from it for an answer of 6.716 or $671.60 ($100 × 6.716)

Answers: 2

Business, 22.06.2019 06:10

P11.2a (lo 2, 4) fechter corporation had the following stockholders’ equity accounts on january 1, 2020: common stock ($5 par) $500,000, paid-in capital in excess of par—common stock $200,000, and retained earnings $100,000. in 2020, the company had the following treasury stock transactions. journalize and post treasury stock transactions, and prepare stockholders’ equity section. mar. 1 purchased 5,000 shares at $8 per share. june 1 sold 1,000 shares at $12 per share. sept. 1 sold 2,000 shares at $10 per share. dec. 1 sold 1,000 shares at $7 per share. fechter corporation uses the cost method of accounting for treasury stock. in 2020, the company reported net income of $30,000. instructions a. journalize the treasury stock transactions, and prepare the closing entry at december 31, 2020, for net income. b. open accounts for (1) paid-in capital from treasury stock, (2) treasury stock, and (3) retained earnings. (post to t-accounts.) c. prepare the stockholders’ equity section for fechter corporation at december 31, 2020.

Answers: 1

Business, 22.06.2019 08:00

3. describe the purpose of the sec. (1-4 sentences. 2.0 points)

Answers: 3

Business, 22.06.2019 11:00

While on vacation in las vegas jennifer, who is from utah, wins a progressive jackpot playing cards worth $15,875 at the casino royale. what implication does she encounter when she goes to collect her prize?

Answers: 1

You know the right answer?

On october 31, 2021, damon company’s general ledger shows a checking account balance of $8,400. the...

Questions

History, 19.07.2019 23:40

Computers and Technology, 19.07.2019 23:40

Spanish, 19.07.2019 23:40

Mathematics, 19.07.2019 23:40

Mathematics, 19.07.2019 23:40

History, 19.07.2019 23:40

Mathematics, 19.07.2019 23:40

Spanish, 19.07.2019 23:40

Computers and Technology, 19.07.2019 23:40

History, 19.07.2019 23:40