Business, 30.09.2019 23:00 alexis3567

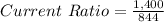

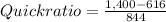

The most recent data from the annual balance sheets of n& b equipment company and jing foodstuffs corporation are as follows: balance sheet december 31st (millions of dollars) jing foodstuffs corporation n& b equipment company jing foodstuffs corporation n& b equipment company assets liabilities current assets current liabilities cash $574 $369 accounts payable $0 $0 accounts receivable 210 135 accruals 127 0 inventories 616 396 notes payable 717 675 total current assets $1,400 $900 total current liabilities $844 $675 net fixed assets long-term bonds 1,031 825 net plant and equipment 1,100 1,100 total debt $1,875 $1,500 common equity common stock $406 $325 retained earnings 219 175 total common equity $625 $500 total assets $2,500 $2,000 total liabilities and equity $2,500 $2,000 n& b equipment company’s current ratio is , and its quick ratio is ; jing foodstuffs corporation’s current ratio is , and its quick ratio is . note: round your values to four decimal places.

Answers: 3

Another question on Business

Business, 21.06.2019 18:10

In a sumif conditional function, what should be the order of terms in the parentheses?

Answers: 1

Business, 21.06.2019 21:30

Recently, verizon wireless ran a pricing trial in order to estimate the elasticity of demand for its services. the manager selected three states that were representative of its entire service area and increased prices by 5 percent to customers in those areas. one week later, the number of customers enrolled in verizon's cellular plans declined 4 percent in those states, while enrollments in states where prices were not increased remained flat. the manager used this information to estimate the own-price elasticity of demand and, based on her findings, immediately increased prices in all market areas by 5 percent in an attempt to boost the company's 2016 annual revenues. one year later, the manager was perplexed because verizon's 2016 annual revenues were 10 percent lower than those in 2015"the price increase apparently led to a reduction in the company's revenues. did the manager make an error? yes - the one-week measures show demand is inelastic, so a price increase will decrease revenues. yes - the one-week measures show demand is elastic, so a price increase will reduce revenues. yes - cell phone elasticity is likely much larger in the long-run than the short-run. no - the cell phone market must have changed between 2011 and 2012 for this price increase to lower revenues.

Answers: 3

Business, 21.06.2019 21:40

Torino company has 1,300 shares of $50 par value, 6.0% cumulative and nonparticipating preferred stock and 13,000 shares of $10 par value common stock outstanding. the company paid total cash dividends of $3,500 in its first year of operation. the cash dividend that must be paid to preferred stockholders in the second year before any dividend is paid to common stockholders is:

Answers: 2

Business, 22.06.2019 01:10

Technology corp. is considering a $238,160 investment in a new marketing campaign that it anticipates will provide annual cash flows of $52,000 for the next five years. the firm has a 6% cost of capital. what should the analysis indicate to the firm's managers?

Answers: 2

You know the right answer?

The most recent data from the annual balance sheets of n& b equipment company and jing foodstuff...

Questions

Mathematics, 19.05.2021 18:20

English, 19.05.2021 18:20

Chemistry, 19.05.2021 18:20

Social Studies, 19.05.2021 18:20

Computers and Technology, 19.05.2021 18:20

Mathematics, 19.05.2021 18:20

Arts, 19.05.2021 18:20

Mathematics, 19.05.2021 18:20

Mathematics, 19.05.2021 18:20