Business, 01.10.2019 22:00 Wolfgirl2032

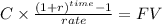

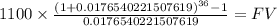

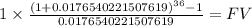

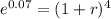

You make a series of quarterly deposits every quarter starting at the end quarter 1 and ending at the end of quarter 36. the first deposit is $1,100, and each deposit increases by $500 each quarter. the nominal annual interest rate is 7%, and is compounded continuously. what is the future value of these series of deposits at the end of quarter 36?

Answers: 3

Another question on Business

Business, 22.06.2019 13:30

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

Business, 23.06.2019 10:30

Usually, government officials make the decisions on the best ways to spend public money true or false

Answers: 1

Business, 23.06.2019 11:30

Alia valbuena earns 68,400 per year as an automotive engineet what is her weekly and monthly salary ?

Answers: 1

Business, 23.06.2019 13:00

Regarding the flow of costs through the inventory accounts, which of the following statements is incorrect? a. the costs flow from raw materials inventory to work-in-process inventory to finished goods inventory. b. the format for computing the amount used, manufactured, or sold is the same for all three inventory accounts. c. the final amount at each stage is added at the beginning of the next stage. d. purchases of raw material and freight in are debited to the work-in-process inventory account.

Answers: 1

You know the right answer?

You make a series of quarterly deposits every quarter starting at the end quarter 1 and ending at th...

Questions

Mathematics, 08.04.2020 01:09

Mathematics, 08.04.2020 01:09

Mathematics, 08.04.2020 01:09

Mathematics, 08.04.2020 01:10

![\sqrt[4]{e^{0.07}}-1 = r__{quarter}](/tpl/images/0280/9851/491e3.png)