Business, 02.10.2019 01:30 shaelyn0920

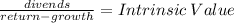

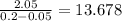

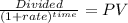

The duo growth company just paid a dividend of $1 per share. the dividend is expected to grow at a rate of 25% per year for the next 3 years and then to level off to 5% per year forever. you think the appropriate market capitalization rate is 20% per year. (a) what is your estimate of the intrinsic value of a share of the stock? (b) if the market price of a share is equal to this intrinsic value, what is the expected dividend yield? (c) what do you expect its price to be 1 year from now? is the implied capital gain consistent with your estimate of the dividend yield and the market capitalization rate? explain.

Answers: 1

Another question on Business

Business, 22.06.2019 06:00

For 2018, rahal's auto parts estimates bad debt expense at 1% of credit sales. the company reported accounts receivable and an allowance for uncollectible accounts of $86,500 and $2,100, respectively, at december 31, 2017. during 2018, rahal's credit sales and collections were $404,000 and $408,000, respectively, and $2,340 in accounts receivable were written off.rahal's accounts receivable at december 31, 2018, are:

Answers: 2

Business, 22.06.2019 23:00

Customers arrive at rich dunn's styling shop at a rate of 3 per hour, distributed in a poisson fashion. rich can perform an average of 5 haircuts per hour, according to a negative exponential distribution.a) the average number of customers waiting for haircuts= customersb) the average number of customers in the shop= customersc) the average time a customer waits until it is his or her turn= minutesd) the average time a customer spends in the shop= minutese) the percentage of time that rich is busy= percent

Answers: 3

Business, 23.06.2019 00:50

On january 1 of the current year, jimmy's sandwich company reported owner's capital totaling $128,000. during the current year, total revenues were $106,000 while total expenses were $95,500. also, during the current year jimmy withdrew $30,000 from the company. no other changes in equity occurred during the year. if, on december 31 of the current year, total assets are $206,000, the change in owner's capital during the year was:

Answers: 3

Business, 23.06.2019 09:30

Although most economic contractions or recessions last sixteen months, the most recent recessionary period referred to as the great recession lasted

Answers: 1

You know the right answer?

The duo growth company just paid a dividend of $1 per share. the dividend is expected to grow at a r...

Questions

Mathematics, 16.10.2019 07:00

Mathematics, 16.10.2019 07:00

History, 16.10.2019 07:00

History, 16.10.2019 07:00

Spanish, 16.10.2019 07:00

Mathematics, 16.10.2019 07:00

Mathematics, 16.10.2019 07:00

Mathematics, 16.10.2019 07:00

Mathematics, 16.10.2019 07:00

Social Studies, 16.10.2019 07:10

![\left[\begin{array}{ccc}Year÷nds&PV\\0&1&1\\1&1.25&1.0417\\2&1.563&1.0854\\3&1.954&1.1308\\3&13.678&7.9155\\Total&&11.17\\\end{array}\right]](/tpl/images/0281/5746/52503.png)