Business, 06.10.2019 05:30 bestielove7425

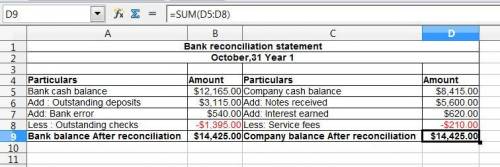

On october 31, year 1, a company general ledger shows a checking account balance of $8,415. the company’s cash receipts for the month total $74,440, of which $71,325 has been deposited in the bank. in addition, the company has written checks for $72,485, of which $71,090 has been processed by the bank. the bank statement reveals an ending balance of $12,165 and includes the following items not yet recorded by the company: bank service fees of $210, note receivable collected by the bank of $5,600, and interest earned on the account balance plus from the note of $620. after closer inspection, the company realizes that the bank incorrectly charged the company’s account $540 for an automatic withdrawal that should have been charged to another customer’s account. the bank agrees to the error. required: 1. prepare a bank reconciliation to calculate the correct ending balance of cash on october 31, year 1. (amounts to be deducted should be indicated with a minus sign.)

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 3

Business, 23.06.2019 12:30

Ricardo is sure he has what it takes to succeed in the food business, but because he lacks management experience, he wants one that will provide the most training and support. which of these possibilities would be his best choice? a. subway b. old macdonald's bed and breakfast c. fuzzy's tavern d. ricardo's café

Answers: 1

Business, 23.06.2019 13:10

Liberty capital had seen its net income increase dramatically from the previous year, yet over the same period of time, its net cash provided from operations had decreased. which of the following would explain how this situation came about? liberty's expenditures on fixed assets had declined. liberty's depreciation and amortization expenses had declined. liberty's interest expense had increased. liberty's cost of goods sold had increased.

Answers: 2

You know the right answer?

On october 31, year 1, a company general ledger shows a checking account balance of $8,415. the comp...

Questions

Mathematics, 10.07.2019 13:30

English, 10.07.2019 13:30

Mathematics, 10.07.2019 13:30

History, 10.07.2019 13:30