Business, 06.10.2019 10:00 brandonleekenyon

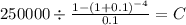

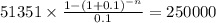

Fe company defaulted on a $250,000 loan that was due on december 31, 2021. the bank has agreed to allow lowlife to repay the $250,000 by making a series of equal annual payments beginning on december 31, 2022. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) required: 1. calculate the required annual payment if the bank’s interest rate is 10% and four payments are to be made.2. calculate the required annual payment if the bank’s interest rate is 8% and five payments are to be made.3. if the bank’s interest rate is 10%, how many annual payments of $51,351 would be required to repay the debt? 4. if three payments of $104,087 are to be made, what interest rate is the bank charging lowlife?

Answers: 1

Another question on Business

Business, 21.06.2019 22:30

What is the connection between digital transformation and customer experience

Answers: 2

Business, 22.06.2019 07:10

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u.s. parent on bank deposits held in london d. interest received by a u.s. parent on a loan to a subsidiary in mexico e. principal repayment received by u.s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u.s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 20:00

Because this market is a monopolistically competitive market, you can tell that it is in long-run equilibrium by the fact thatmr=mc at the optimal quantity for each firm. furthermore, a monopolistically competitive firm's average total cost in long-run equilibrium isless than the minimum average total cost. true or false: this indicates that there is a markup on marginal cost in the market for engines. true false monopolistic competition may also be socially inefficient because there are too many or too few firms in the market. the presence of the externality implies that there is too little entry of new firms in the market.

Answers: 3

Business, 23.06.2019 00:00

Which of the following statements is true about an atm card?

Answers: 1

You know the right answer?

Fe company defaulted on a $250,000 loan that was due on december 31, 2021. the bank has agreed to al...

Questions

Mathematics, 05.02.2020 10:52

Mathematics, 05.02.2020 10:52

Computers and Technology, 05.02.2020 10:52

Chemistry, 05.02.2020 10:52

Mathematics, 05.02.2020 10:52

Mathematics, 05.02.2020 10:52

Mathematics, 05.02.2020 10:52

Business, 05.02.2020 10:52

Mathematics, 05.02.2020 10:52

Mathematics, 05.02.2020 10:53

History, 05.02.2020 10:53