Answers: 2

Another question on Business

Business, 22.06.2019 10:40

Parks corporation is considering an investment proposal in which a working capital investment of $10,000 would be required. the investment would provide cash inflows of $2,000 per year for six years. the working capital would be released for use elsewhere when the project is completed. if the company's discount rate is 10%, the investment's net present value is closest to (ignore income taxes) ?

Answers: 1

Business, 22.06.2019 11:10

Suppose that the firm cherryblossom has an orchard they are willing to sell today. the net annual returns to the orchard are expected to be $50,000 per year for the next 20 years. at the end of 20 years, it is expected the land will sell for $30,000. calculate the market value of the orchard if the market rate of return on comparable investments is 16%.

Answers: 1

Business, 22.06.2019 17:00

Zeta corporation is a manufacturer of sports caps, which require soft fabric. the standards for each cap allow 2.00 yards of soft fabric, at a cost of $2.00 per yard. during the month of january, the company purchased 25,000 yards of soft fabric at $2.10 per yard, to produce 12,000 caps. what is zeta corporation's materials price variance for the month of january?

Answers: 2

Business, 23.06.2019 00:30

How much of your paycheck do you have immediate access to once you deposit it into your bank account a. all of it b. a portion of it c. none of it

Answers: 1

You know the right answer?

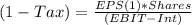

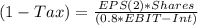

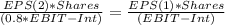

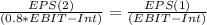

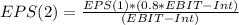

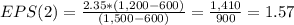

Harris inc. has ebit of $1,500 and debt of $5,000 on which it pays 12% interest. its eps is currentl...

Questions

Computers and Technology, 10.05.2021 14:00

English, 10.05.2021 14:00

Chemistry, 10.05.2021 14:00

Business, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00

Social Studies, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00

Mathematics, 10.05.2021 14:00