Business, 10.10.2019 00:30 saigeshort

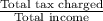

Consider the following hypothetical income tax brackets for a married couple. assume for simplicity there are no exemptions or deductions. income tax rate $0-$20,000 5% $20,000-$50,000 20 $50,000-$100,000 45 over $100,000 55 suppose the couple's income is $60 comma 000. what is the couple's marginal tax rate? the couple's marginal tax rate is 45 percent. (enter your response as an integer.) what is their average tax rate? the couple's average tax rate is nothing percent. (enter your response as an integer)

Answers: 2

Another question on Business

Business, 21.06.2019 19:30

The selling price of houses would be most likely to decrease if there were first a decrease in which of the following? a. new-housing construction. b. mortgage interest rates. c. the unemployment rate. d. construction workers' wages. 2b2t

Answers: 1

Business, 22.06.2019 05:30

Suppose jamal purchases a pair of running shoes online for $60. if his state has a sales tax on clothing of 6 percent, how much is he required to pay in state sales tax?

Answers: 3

Business, 22.06.2019 07:00

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 11:00

Factors like the unemployment rate,the stock market,global trade,economic policy,and the economic situation of other countries have no influence on the financial status of individuals. true or false

Answers: 1

You know the right answer?

Consider the following hypothetical income tax brackets for a married couple. assume for simplicity...

Questions

Mathematics, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Arts, 27.09.2021 14:00

Chemistry, 27.09.2021 14:00

English, 27.09.2021 14:00

Spanish, 27.09.2021 14:00

Spanish, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

History, 27.09.2021 14:00