Business, 10.10.2019 04:00 jazminemartinez3223

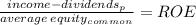

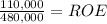

Selected information for irvington company is as follows: december 31year 1 year 2preferred stock, 8%, par $100, nonconvertible, noncumulative $125,000 $125,000common stock 300,000 400,000retained earnings 75,000 185,000dividends paid on preferred stock for year ended 10,000 10,000net income for year ended 60,000 120,000irvington's return on common stockholders' equity, rounded to the nearest percentage point, for year 2 is

Answers: 1

Another question on Business

Business, 23.06.2019 10:30

According to the graph, how much did individuals making $20,000 to $50,000 a year pay in income taxes? according to the graph, how much revenue did the government receive from individuals earning $200,000 and above?

Answers: 2

Business, 23.06.2019 12:30

Mason farms purchased a building for $689,000 eight years ago. six years ago, repairs costing $136,000 were made to the building. the annual taxes on the property are $11,000. the building has a current market value of $840,000 and a current book value of $494,000. the building is totally paid for and solely owned by the firm. if the company decides to use this building for a new project, what value, if any, should be included in the initial cash flow of the project for this building? $0$582,000$840,000$865,000$953,000

Answers: 3

Business, 23.06.2019 15:00

Alamar petroleum company offers its employees the option of contributing retirement funds up to 5% of their wages or salaries, with the contribution being matched by alamar. the company also pays 80% of medical and life insurance premiums. deductions relating to these plans and other payroll information for the first biweekly payroll period of february are listed as follows: wages and salaries $ 2,800,000 employee contribution to voluntary retirement plan 92,000 medical insurance premiums 50,000 life insurance premiums 9,800 federal income taxes to be withheld 480,000 local income taxes to be withheld 61,000 payroll taxes: federal unemployment tax rate 0.60 % state unemployment tax rate (after futa deduction) 5.40 % social security tax rate 6.20 % medicare tax rate 1.45 % required: prepare the appropriate journal entries to record salaries and wages expense and payroll tax expense for the biweekly pay period. assume that no employee's cumulative wages exceed the relevant wage bases for social security, and that all employees' cumulative wages do exceed the relevant unemployment wage bases.

Answers: 3

You know the right answer?

Selected information for irvington company is as follows: december 31year 1 year 2preferred stock, 8...

Questions

English, 26.02.2022 07:30

SAT, 26.02.2022 07:30

Social Studies, 26.02.2022 07:30

History, 26.02.2022 07:30

SAT, 26.02.2022 07:40

Mathematics, 26.02.2022 07:40

History, 26.02.2022 07:40