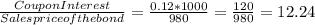

Wool express (we) has a capital structure of 30% debt and 70% equity. we is considering a project that requires an investment of$2.6 million. to finance this project, we plans to issue 10-year bonds with a coupon interest rate of 12%. each of these bonds has a $1,000 face value and will be sold to net we $980. if the current risk-free rate is 7% and the expected market return is 14.5%, what is the weighted cost of capital for we? assume we has a beta of 1.20 and a marginal tax rate of 40%.

Answers: 2

Another question on Business

Business, 21.06.2019 19:50

Which of the following best explains why treasury bonds have an effect on the size of the money supply? a. the amount of treasury bonds in circulation affects both unemployment and inflation. b. the government can spend more money and charge lower taxes by using treasury bonds. c. the federal reserve bank can buy and sell these bonds to raise or lower bank deposits. d. the interest paid on treasury bonds influences the interest rates charged by private banks. 2b2t

Answers: 1

Business, 22.06.2019 00:40

Eileen's elegant earrings produces pairs of earrings for its mail order catalogue business. each pair is shipped in a separate box. she rents a small room for $150 a week in the downtown business district that serves as her factory. she can hire workers for $275 a week. there are no implicit costs. what is the marginal product of the second worker?

Answers: 3

Business, 22.06.2019 12:20

If jobs have been undercosted due to underallocation of manufacturing overhead, then cost of goods sold (cogs) is too low and which of the following corrections must be made? a. decrease cogs for double the amount of the underallocation b. increase cogs for double the amount of the underallocation c. decrease cogs for the amount of the underallocation d. increase cogs for the amount of the underallocation

Answers: 3

Business, 22.06.2019 19:50

Managers in a firm hired to improve the firm's profitability and ultimately the shareholders' value will add to the overall costs if they pursue their own self-interests. what does this best illustrate? a. diseconomies of scale b. principal-agent problem c. experience-curveeffects d. information asymmetries

Answers: 1

You know the right answer?

Wool express (we) has a capital structure of 30% debt and 70% equity. we is considering a project th...

Questions

Geography, 16.09.2019 23:10

Biology, 16.09.2019 23:10

Biology, 16.09.2019 23:10

Geography, 16.09.2019 23:10

Mathematics, 16.09.2019 23:10

Computers and Technology, 16.09.2019 23:10

=7% ; Expected market rate,

=7% ; Expected market rate,  =14.5% ; Beta,

=14.5% ; Beta,  = 1.20; Tax-Rate,

= 1.20; Tax-Rate,  =40%

=40% %

% , we shall use the CAPM formula below

, we shall use the CAPM formula below