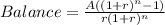

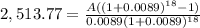

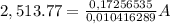

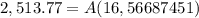

Jeff has a balance of $2,513.77 on his credit card. he would like to pay off his card over the course of a year and a half by making identical monthly payments. the apr on his card is 10.66%, compounded monthly. assuming that jeff makes no additional purchases with his card, how much will he have to pay every month to reach his goal? (round all dollar values to the nearest cent.) a. $151.73 b. $162.57 c. $139.65 d. $147.64 select the best answer from the choices provided a b c d

Answers: 2

Another question on Business

Business, 22.06.2019 02:50

Acompany set up a petty cash fund with $800. the disbursements are as follows: office supplies $300 shipping $50 postage $30 delivery expense $350 to create the fund, which account should be credited? a. postage b. cash at bank c. supplies d. petty cash

Answers: 2

Business, 22.06.2019 08:40

Which of the following is not a characteristic of enterprise applications that cause challenges in implementation? a. they introduce "switching costs," making the firm dependent on the vendor. b. they cause integration difficulties as every vendor uses different data and processes. c. they are complex and time consuming to implement. d. they support "best practices" for each business process and function. e. they require sweeping changes to business processes to work with the software.

Answers: 1

Business, 22.06.2019 10:30

The advertisement demonstrates a popular way companies try to sell a product. what should consumers consider when it comes to the price of this product? it includes shipping and handling costs. it takes into account maintenance costs. it explains why this price is a good deal. it makes the full cost appears lower than it is.

Answers: 1

Business, 22.06.2019 17:10

At the end of the current year, accounts receivable has a balance of $550,000; allowance for doubtful accounts has a credit balance of $5,500; and sales for the year total $2,500,000. an analysis of receivables estimates uncollectible receivables as $25,000. determine the net realizable value of accounts receivable after adjustment. (hint: determine the amount of the adjusting entry for bad debt expense and the adjusted balance of allowance of doubtful accounts.)

Answers: 3

You know the right answer?

Jeff has a balance of $2,513.77 on his credit card. he would like to pay off his card over the cours...

Questions

Physics, 26.06.2019 17:30

Biology, 26.06.2019 17:30

English, 26.06.2019 17:30

Arts, 26.06.2019 17:30

Biology, 26.06.2019 17:30

History, 26.06.2019 17:30

Mathematics, 26.06.2019 17:30

Mathematics, 26.06.2019 17:30

Biology, 26.06.2019 17:30

Physics, 26.06.2019 17:30

Mathematics, 26.06.2019 17:30