Business, 11.10.2019 22:10 lydia1melton

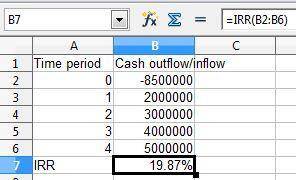

Jamaica corp. is adding a new assembly line at a cost of $8.5 million. the firm expects the project to generate cash flows of $2 million, $3 million, $4 million, and $5 million over the next four years. its cost of capital is 16 percent. what is the internal rate of return (irr) that jamaica can earn on this project and should the project be accepted? (round to the nearest percent)?

Answers: 2

Another question on Business

Business, 22.06.2019 01:30

The strength of the economy depends on the balance pf production and consumption of goods and consumption of goods and services

Answers: 1

Business, 22.06.2019 13:00

Creation landscaping has 1,000 bonds outstanding that are selling for $1,280 each. the company also has 2,000 shares of preferred stock outstanding, currently priced at $27.20 a share. the common stock is priced at $37.00 a share and there are 28,000 shares outstanding. what is the weight of the debt as it relates to the firm's weighted average cost of capital?

Answers: 1

Business, 22.06.2019 21:10

The blumer company entered into the following transactions during 2012: 1. the company was started with $22,000 of common stock issued to investors for cash. 2. on july 1, the company purchased land that cost $15,500 cash. 3. there were $700 of supplies purchased on account. 4. sales on account amounted to $9,500. 5. cash collections of receivables were $5,500. 6. on october 1, 2012, the company paid $3,600 in advance for a 12-month insurance policy that became effective on october 1. 7. supplies on hand as of december 31, 2010 amounted to $225. the amount of cash flow from investing activities would be:

Answers: 2

You know the right answer?

Jamaica corp. is adding a new assembly line at a cost of $8.5 million. the firm expects the project...

Questions

Mathematics, 27.10.2019 04:43

Physics, 27.10.2019 04:43

Mathematics, 27.10.2019 04:43

Social Studies, 27.10.2019 04:43

History, 27.10.2019 04:43

English, 27.10.2019 04:43

English, 27.10.2019 04:43

Biology, 27.10.2019 04:43

Mathematics, 27.10.2019 04:43