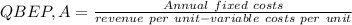

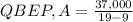

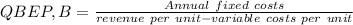

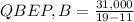

Asmall firm intends to increase the capacity of a bottleneck operation by adding a new machine. two alternatives, a and b, have been identified, and the associated costs and revenues have been estimated. annual fixed costs would be $37,000 for a and $31,000 for b; variable costs per unit would be $9 for a and $11 for b; and revenue per unit would be $19. a. determine each alternative’s break-even point in units. (round your answer to the nearest whole amount.) qbep, a 3700 units qbep, b 3875 units b. at what volume of output would the two alternatives yield the same profit (or loss)? (round your answer to the nearest whole amount.) profit units c. if expected annual demand is 15,000 units, which alternative would yield the higher profit (or the lower loss)? higher profit

Answers: 2

Another question on Business

Business, 21.06.2019 15:30

Josie, an unmarried taxpayer, has $155,000 in salary, $10,000 in income from a passive investment in a limited partnership, and a $26,000 passive loss from a real estate rental activity in which she actively participates. if her modified adjusted gross income is $155,000, how much of the $26,000 loss is deductible

Answers: 1

Business, 21.06.2019 20:00

Answer the following questions using the data given below. annual percent return on mutual funds (n = 17) last year (x) this year (y) 11.9 15.4 19.5 26.7 11.2 18.2 14.1 16.7 14.2 13.2 5.2 16.4 20.7 21.1 11.3 12.0 –1.1 12.1 3.9 7.4 12.9 11.5 12.4 23.0 12.5 12.7 2.7 15.1 8.8 18.7 7.2 9.9 5.9 18.9

Answers: 3

Business, 21.06.2019 22:40

Lincoln company has an accounting policy for internal reporting purposes whereby the costs of any research and development projects that are over 70 percent likely to succeed are capitalized and then depreciated over a five-year period with a full year of depreciation in the year of capitalization. in the current year, $400,000 was spent on project one, and it was 55 percent likely to succeed, $600,000 was spent on project two, and it was 65 percent likely to succeed, and $900,000 was spent on project three, and it was 75 percent likely to succeed. in converting the internal financial statements to external financial statements, by how much will net income for the current year have to be reduced? a. $180,000b. $380,000c. $720,000d. $900,000

Answers: 3

Business, 22.06.2019 02:50

Acompany set up a petty cash fund with $800. the disbursements are as follows: office supplies $300 shipping $50 postage $30 delivery expense $350 to create the fund, which account should be credited? a. postage b. cash at bank c. supplies d. petty cash

Answers: 2

You know the right answer?

Asmall firm intends to increase the capacity of a bottleneck operation by adding a new machine. two...

Questions

Mathematics, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

Spanish, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

History, 13.05.2021 21:00

Biology, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

History, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

Mathematics, 13.05.2021 21:00

History, 13.05.2021 21:00