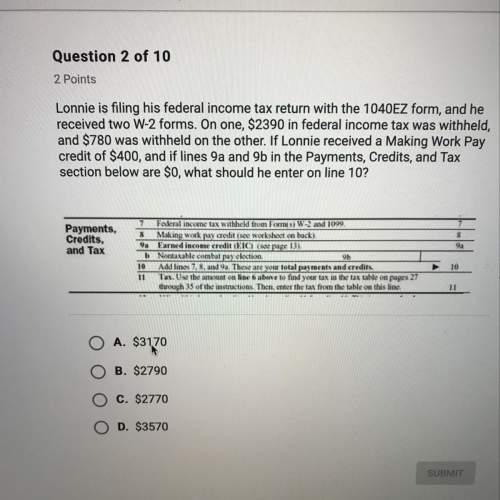

Lonnie is filing his federal income tax return with the 1040ez form, and he

received two w-2 f...

Business, 16.10.2019 04:10 mattdallas6214

Lonnie is filing his federal income tax return with the 1040ez form, and he

received two w-2 forms. on one, $2390 in federal income tax was withheld,

and $780 was withheld on the other. if lonnie received a making work pay

credit of $400, and if lines 9a and 9b in the payments, credits, and tax

section below are $0, what should he enter on line 10?

payments.

credits,

and tax

3

9

federal income tax withheld from formis) w2 and 1099

making work pay credit (see worksheet on back)

earned income credit to see pape 13)

nectable combat pay election

add lines 7.8.anda. these are your total payments and credits

tau. use the amount on line 6 above to find your tax in the tax table on pages 27

through 35 of the instructions. then, enter the tax from the table on this line

10

o a. $3170

b. $2790

o c. $2770

o d. $3570

Answers: 2

Another question on Business

Business, 22.06.2019 02:30

Consider how health insurance affects the quantity of health care services performed. suppose that the typical medical procedure has a cost of $160, yet a person with health insurance pays only $40 out of pocket. her insurance company pays the remaining $120. (the insurance company recoups the $120 through premiums, but the premium a person pays does not depend on how many procedures that person chooses to undergo.) consider the following demand curve in the market for medical care. use the black point (plus symbol) to indicate the quantity of procedures demanded if each procedure has a price of $160. then use the grey point (star symbol) to indicate the quantity of procedures demanded if each procedure has a price of $40. q d at p=$160 q d at p=$40 0 10 20 30 40 50 60 70 80 90 100 200 180 160 140 120 100 80 60 40 20 0 price of medical procedures quantity of medical procedures demand if the cost of each procedure to society is truly $160, the quantity that maximizes total surplus is procedures. economists often blame the health insurance system for excessive use of medical care. given your analysis, the use of care might be viewed as excessive because consumers get procedures whose value is than the cost of producing them.

Answers: 1

Business, 22.06.2019 23:10

Mr. pines is considering buying a house and renting it to students. the yearly operating costs are $1,900. the house can be sold for $175,000 at the end of 10 years and it is considered 18% to be a suitable annual effective interest rate. if the house costs $100,000 to purchase, how much would you need to charge your tenants each year in rent? (assume a single payment for the years rent at the end of each year)

Answers: 1

Business, 23.06.2019 02:30

How is the role of government determined in the american free enterprise system?

Answers: 2

Business, 23.06.2019 15:00

Baskin promotions, inc. sells t-shirts decorated for a variety of concert performers. the company has developed the following budget for the coming year based on a sales forecast of 80,000 t-shirts: sales $ 1,400,000 cost of goods sold 820,000 gross profit 580,000 operating expenses ($100,000 is fixed) 418,400 operating income 161,600 income taxes (30% of operating income) 48,480 net income $ 113,120 cost of goods sold and variable operating expenses vary directly with sales, and the income tax rate is 30% at all levels of operating income. if the concert season is slow due to poor weather, baskin estimates that sales could fall to as low as 60,000 t-shirts. assume baskin actually achieves the 60,000 unit sales level, and that net income actually earned at this level was $70,000. a performance report would indicate that net income was:

Answers: 2

You know the right answer?

Questions

History, 25.09.2019 17:30

Mathematics, 25.09.2019 17:30

Biology, 25.09.2019 17:30

English, 25.09.2019 17:30

Mathematics, 25.09.2019 17:30

History, 25.09.2019 17:30

English, 25.09.2019 17:30

Spanish, 25.09.2019 17:30

Geography, 25.09.2019 17:30

History, 25.09.2019 17:30

History, 25.09.2019 17:30

Physics, 25.09.2019 17:30

English, 25.09.2019 17:30

History, 25.09.2019 17:30