Business, 16.10.2019 05:30 mustachbrah

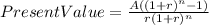

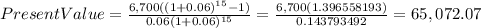

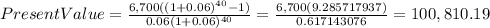

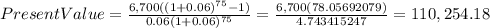

An investment offers $6,700 per year, with the first payment occurring one year from now. the required return is 6 percent. a. what would the value be today if the payments occurred for 15 years? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what would the value be today if the payments occurred for 40 years? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. what would the value be today if the payments occurred for 75 years? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) d. what would the value be today if the payments occurred forever? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 2

Another question on Business

Business, 22.06.2019 09:40

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 19:30

Each row in a database is a set of unique information called a(n) table. record. object. field.

Answers: 3

Business, 22.06.2019 20:40

Financial performance is measured in many ways. requirements 1. explain the difference between lag and lead indicators. 2. the following is a list of financial measures. indicate whether each is a lag or lead indicator: a. income statement shows net income of $100,000 b. listing of next week's orders of $50,000 c. trend showing that average hits on the redesigned website are increasing at 5% per week d. price sheet from vendor reflecting that cost per pound of sugar for the next month is $2 e. contract signed last month with large retail store that guarantees a minimum shelf space for grandpa's overloaded chocolate cookies for the next year

Answers: 2

Business, 22.06.2019 23:10

Powell company began the 2018 accounting period with $40,000 cash, $86,000 inventory, $60,000 common stock, and $66,000 retained earnings. during 2018, powell experienced the following events: sold merchandise costing $58,000 for $99,500 on account to prentise furniture store. delivered the goods to prentise under terms fob destination. freight costs were $900 cash. received returned goods from prentise. the goods cost powell $4,000 and were sold to prentise for $5,900. granted prentise a $3,000 allowance for damaged goods that prentise agreed to keep. collected partial payment of $81,000 cash from accounts receivable. required record the events in a statements model shown below. prepare an income statement, a balance sheet, and a statement of cash flows. why would prentise agree to keep the damaged goods?

Answers: 2

You know the right answer?

An investment offers $6,700 per year, with the first payment occurring one year from now. the requir...

Questions

Computers and Technology, 31.12.2019 21:31

Mathematics, 31.12.2019 21:31

Mathematics, 31.12.2019 21:31

History, 31.12.2019 21:31

Mathematics, 31.12.2019 21:31

Social Studies, 31.12.2019 21:31

Mathematics, 31.12.2019 21:31

Social Studies, 31.12.2019 21:31

Mathematics, 31.12.2019 21:31