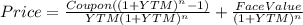

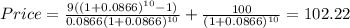

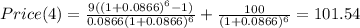

Suppose you purchase a ten-year bond with 9% annual coupons. you hold the bond for four years and sell it immediately after receiving the fourth coupon. if the bond’s ytm was 8.66% when you purchased and sold the bond. what cash flows will you pay at the purchase and what cash flows will you receive at the sale (including any coupon received immediately before sale) from you investment in the bond per $100 face value? how much interest income will you earn for holding this bond for four years in total?

Answers: 1

Another question on Business

Business, 22.06.2019 11:30

11. before adding cream to a simmering soup, you need to a. simmer the cream. b. chill the cream. c. strain the cream through cheesecloth. d. allow the cream reach room temperature. student d incorrect which answer is right?

Answers: 2

Business, 22.06.2019 12:10

Drag each label to the correct location on the image determine which actions by a manager are critical interactions - listening to complaints - interacting with customers - responding to complaints - assigning staff duties -taking action to address customer grievances -keeping track of reservations

Answers: 2

Business, 22.06.2019 14:00

How many months does the federal budget usually take to prepare

Answers: 1

You know the right answer?

Suppose you purchase a ten-year bond with 9% annual coupons. you hold the bond for four years and se...

Questions

Mathematics, 04.10.2021 01:00

Mathematics, 04.10.2021 01:00

Mathematics, 04.10.2021 01:00

Mathematics, 04.10.2021 01:00

Mathematics, 04.10.2021 01:00

English, 04.10.2021 01:00

Chemistry, 04.10.2021 01:00

Biology, 04.10.2021 01:00