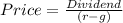

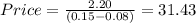

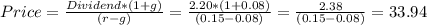

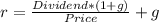

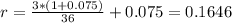

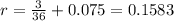

Your broker recommends that you purchase good mills at $30. the stock pays a $2.20 annual dividend, which (like its per share earnings) is expected to grow annually at 8 percent. if you want to earn 15 percent on your funds, is this stock a good buy and why? show your work. i do not want a simple yes or no answer. if you purchase large oil, inc. for $36 and the firm pays a $3.00 annual dividend which you expect to grow at 7.5 percent, what is the implied annual rate of return on your investment?

Answers: 2

Another question on Business

Business, 22.06.2019 22:00

You wish to retire in 13 years, at which time you want to have accumulated enough money to receive an annual annuity of $23,000 for 18 years after retirement. during the period before retirement you can earn 9 percent annually, while after retirement you can earn 11 percent on your money. what annual contributions to the retirement fund will allow you to receive the $23,000 annuity? use appendix c and appendix d for an approximate answer, but calculate your final answer using the formula and financial calculator methods.

Answers: 1

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 2

Business, 23.06.2019 03:00

Predict how the price of athletic shorts would change if schools banned their use

Answers: 2

Business, 23.06.2019 06:00

Before setting your prices, it's wise to a. subtract your profit margin from your costs. b. research industry standards. c. memorize the formula for cost plus. d. ignore your competitors' prices.

Answers: 1

You know the right answer?

Your broker recommends that you purchase good mills at $30. the stock pays a $2.20 annual dividend,...

Questions

Mathematics, 18.06.2020 06:57

Mathematics, 18.06.2020 06:57

Mathematics, 18.06.2020 06:57

Mathematics, 18.06.2020 06:57

Physics, 18.06.2020 06:57

Mathematics, 18.06.2020 06:57

Mathematics, 18.06.2020 06:57

Mathematics, 18.06.2020 06:57