Business, 18.10.2019 03:30 vinniemccray70

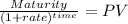

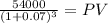

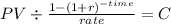

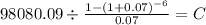

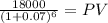

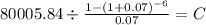

You can choose between machine a or b. your annual interest rate is 7%. you need a machine for 6 years (required service period). 1. machine a costs $54,000 and lasts for 3 years. it has no salvage value and costs an additional $18,000 each year to operate. 2. machine b costs $92,000 and lasts for 6 years. it has a salvage value of $18,000 and costs $13,000/year to operate. assume both machines can be purchased again for the same costs. what is the annual equivalent cost of the machine that you should purchase?

Answers: 1

Another question on Business

Business, 22.06.2019 08:40

Which of the following is not a characteristic of enterprise applications that cause challenges in implementation? a. they introduce "switching costs," making the firm dependent on the vendor. b. they cause integration difficulties as every vendor uses different data and processes. c. they are complex and time consuming to implement. d. they support "best practices" for each business process and function. e. they require sweeping changes to business processes to work with the software.

Answers: 1

Business, 22.06.2019 17:00

Oliver is the vice president of production at his company and has been managing the launch of new software systems. he worked with a team of individuals who were tasked to create awareness about a specific product and also to approach potential purchasers of the product. which department managers were part of oliver’s team?

Answers: 3

Business, 22.06.2019 18:00

Your subscription to investing wisely weekly is about to expire. you plan to subscribe to the magazine for the rest of your life, and you can renew it by paying $85 annually, beginning immediately, or you can get a lifetime subscription for $620, also payable immediately. assuming that you can earn 6.0% on your funds and that the annual renewal rate will remain constant, how many years must you live to make the lifetime subscription the better buy?

Answers: 2

Business, 22.06.2019 19:50

Bulldog holdings is a u.s.-based consumer electronics company. it owns smaller firms in japan and taiwan where most of its cell phone technology is developed and manufactured before being released worldwide. which of the following alternatives to integration does this best illustrate? a. venture capitalism b. franchising c. joint venture d. parent-subsidiary relationship

Answers: 2

You know the right answer?

You can choose between machine a or b. your annual interest rate is 7%. you need a machine for 6 yea...

Questions

History, 26.11.2021 20:30

Mathematics, 26.11.2021 20:30

Social Studies, 26.11.2021 20:30

Business, 26.11.2021 20:40

Mathematics, 26.11.2021 20:40

Mathematics, 26.11.2021 20:40

Computers and Technology, 26.11.2021 20:40

Social Studies, 26.11.2021 20:40

Mathematics, 26.11.2021 20:40