This problem has been solved!

see the answer

sellall department stores reported the fol...

This problem has been solved!

see the answer

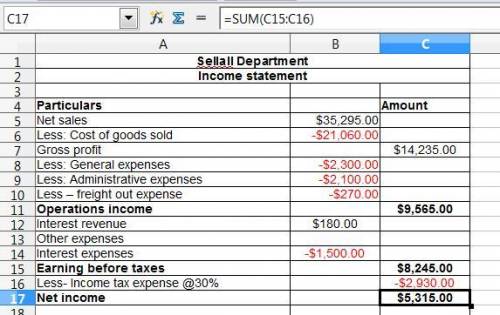

sellall department stores reported the following amounts in its adjusted trial balance prepared as of its december 31 year-end: administrative expenses, $2,100; cost of goods sold, $21,060; income tax expense, $2,930; interest expense, $1,500; interest revenue, $180; general expenses, $2,300; sales revenue, $39,000; sales discounts, $1,950; sales returns and allowances, $1,755; and delivery (freight-out) expense, $270.

prepare a multistep income statement for distribution to external financial statement users. fill in the blank and the rest of the table

sellall department stores

income statement

for the year ended december 31

cost of goods sold 21,060

gross profit

operating expenses 4,670

income from operations

interest revenue 180

income before income tax expense

net income $

Answers: 3

Another question on Business

Business, 22.06.2019 14:00

Which of the following would be an accurate statement about achieving a balanced budget

Answers: 1

Business, 22.06.2019 17:30

Palmer frosted flakes company offers its customers a pottery cereal bowl if they send in 3 boxtops from palmer frosted flakes boxes and $1. the company estimates that 60% of the boxtops will be redeemed. in 2012, the company sold 675,000 boxes of frosted flakes and customers redeemed 330,000 boxtops receiving 110,000 bowls. if the bowls cost palmer company $3 each, how much liability for outstanding premiums should be recorded at the end of 2012?

Answers: 2

Business, 22.06.2019 22:20

Which of the following events could increase the demand for labor? a. an increase in the marginal productivity of workers b. a decrease in the amount of capital available for workers to use c. a decrease in the wage paid to workers d. a decrease in output price

Answers: 1

Business, 23.06.2019 02:20

Speedy auto repairs uses a job-order costing system. the company’s direct materials consist of replacement parts installed in customer vehicles, and its direct labor consists of the mechanics’ hourly wages. speedy’s overhead costs include various items, such as the shop manager’s salary, depreciation of equipment, utilities, insurance, and magazine subscriptions and refreshments for the waiting room. the company applies all of its overhead costs to jobs based on direct labor-hours. at the beginning of the year, it made the following estimates: direct labor-hours required to support estimated output 20,000 fixed overhead cost $ 350,000 variable overhead cost per direct labor-hour $ 1.00 required: 1. compute the predetermined overhead rate. 2. during the year, mr. wilkes brought in his vehicle to replace his brakes, spark plugs, and tires. the following information was available with respect to his job: direct materials $ 590 direct labor cost $ 109 direct labor-hours used 6

Answers: 1

You know the right answer?

Questions

Medicine, 10.03.2020 08:27

Mathematics, 10.03.2020 08:27

Mathematics, 10.03.2020 08:27