Business, 23.10.2019 03:00 neverfnmind

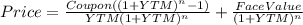

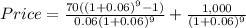

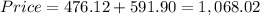

Suppose that general motors acceptance corporation issued a bond with 10 years until maturity, a face value of $1000, and a coupon rate of 7% (annual payments). the yield to maturity on this bond when it was issued was 6%. assuming the yield to maturity remains constant, what is the price of the bond immediately after it makes its first coupon payment?

Answers: 2

Another question on Business

Business, 22.06.2019 08:00

How do communism and socialism differ in terms of the role that government plays in the economy ?

Answers: 1

Business, 22.06.2019 17:00

Dan wants to start a supermarket in his hometown, and wants to get into the business only after finding out about the market and how successful his business might be. the best way for dan to gain knowledge is to:

Answers: 2

Business, 22.06.2019 19:50

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

Business, 22.06.2019 23:40

Martha is one producer in the perfectly competitive jelly industry. last year, martha and all of her competitors found themselves earning economic profits. if there is free entry and exit, what do you expect to happen to the number of suppliers in the industry and the price of jelly? the number of suppliers will increase, and the price of jelly will fall. the number of suppliers will decrease, and the price of jelly will increase. the number of suppliers will increase, and the price of jelly will increase. the number of suppliers will decrease, and the price of jelly will fall.

Answers: 3

You know the right answer?

Suppose that general motors acceptance corporation issued a bond with 10 years until maturity, a fac...

Questions

Mathematics, 26.01.2021 20:30

Mathematics, 26.01.2021 20:30

History, 26.01.2021 20:30

Computers and Technology, 26.01.2021 20:30

History, 26.01.2021 20:30

French, 26.01.2021 20:30

Mathematics, 26.01.2021 20:30

Mathematics, 26.01.2021 20:30

History, 26.01.2021 20:30

Mathematics, 26.01.2021 20:30

Mathematics, 26.01.2021 20:30