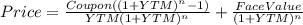

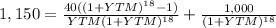

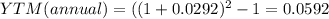

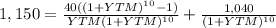

Mr. clark is considering another bond, bond d. it has an 8% semiannual coupon and a $1,000 face value (i. e., it pays a $40 coupon every 6 months). bond d is scheduled to mature in 9 years and has a price of $1,150. it is also callable in 5 years at a call price of $1,040. what is the bond’s nominal yield to maturity? what is the bond’s nominal yield to call? if mr. clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? explain your answer.

Answers: 3

Another question on Business

Business, 22.06.2019 09:00

Harry is 25 years old with a 1.55 rating factor for his auto insurance. if his annual base premium is $1,012, what is his total premium? $1,568.60 $2,530 $1,582.55 $1,842.25

Answers: 3

Business, 22.06.2019 11:00

Abank provides its customers mobile applications that significantly simplify traditional banking activities. for example, a customer can use a smartphone to take a picture of a check and electronically deposit into an account. this unique service demonstrates the bank’s desire to practice which one of porter’s strategies?

Answers: 3

Business, 22.06.2019 12:00

In the united states, one worker can produce 10 tons of steel per day or 20 tons of chemicals per day. in the united kingdom, one worker can produce 5 tons of steel per day or 15 tons of chemicals per day. the united kingdom has a comparative advantage in the production of:

Answers: 2

Business, 22.06.2019 21:00

Haley photocopying purchases a paper from an out-of-state vendor. average weekly demand for paper is 150 cartons per week for which haley pays $15 per carton. in bound shipments from the vendor average 1000 cartoons with an average lead time of 3 weeks. haley operates 52 weeks per year; it carries a 4-week supply of inventory as safety stock and no anticipation inventory. the vendor has recently announced that they will be building a faculty near haley photocopying that will reduce lead time to one week. further, they will be able to reduce shipments to 200 cartons. haley believes that they will be able to reduce safety stock to a 1-week supply. what impact will these changes make to haley’s average inventory level and its average aggregated inventory value?

Answers: 1

You know the right answer?

Mr. clark is considering another bond, bond d. it has an 8% semiannual coupon and a $1,000 face valu...

Questions

Social Studies, 02.07.2019 03:00

Mathematics, 02.07.2019 03:00

Mathematics, 02.07.2019 03:00

Physics, 02.07.2019 03:00

History, 02.07.2019 03:00

English, 02.07.2019 03:00

History, 02.07.2019 03:00

English, 02.07.2019 03:00

Chemistry, 02.07.2019 03:00

Mathematics, 02.07.2019 03:00