Business, 24.10.2019 23:43 angieboyd1pe3jme

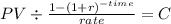

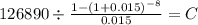

Manufacturers southern leased high-tech electronic equipment from international machines on january 1, 2018. international machines manufactured the equipment at a cost of $99,000. manufacturers southern's fiscal year ends december 31. (fv of $1, pv of $1, fva of $1, pva of $1, fvad of $1 and pvad of $1) (use appropriate factor(s) from the tables provided.) related information: lease term 2 years (8 quarterly periods) quarterly rental payments $16,700 at the beginning of each period economic life of asset 2 years fair value of asset $126,890 implicit interest rate 6% required: 1. show how international machines determined the $16,700 quarterly lease payments. 2. prepare appropriate entries for international machines to record the lease at its beginning, january 1, 2018, and the second lease payment on april 1, 2018.

Answers: 1

Another question on Business

Business, 22.06.2019 09:00

Consider the scenario below and let us know if you believe lauren smith's actions to be ethical. let us know why or why not. lauren smith is the controller for sports central, a chain of sporting goods stores. she has been asked to recommend a site for a new store. lauren has an uncle who owns a shopping plaza in the area of town where the new store is to be located, so she decides to contact her uncle about leasing space in his plaza. lauren also contacted several other shopping plazas and malls, but her uncle’s store turned out to be the most economical place to lease. therefore, lauren recommended locating the new store in her uncle’s shopping plaza. in making her recommendation to management, she did not disclose that her uncle owns the shopping plaza. if management decided to go with lauren's uncle's plaza, what additional information would be needed in the financial statements?

Answers: 2

Business, 22.06.2019 10:30

The card shoppe needs to maintain 21 percent of its sales in net working capital. currently, the store is considering a four-year project that will increase sales from its current level of $349,000 to $408,000 the first year and to $414,000 a year for the following three years of the project. what amount should be included in the project analysis for net working capital in year 4 of the project?

Answers: 3

You know the right answer?

Manufacturers southern leased high-tech electronic equipment from international machines on january...

Questions

History, 26.06.2019 11:30

Social Studies, 26.06.2019 11:30

Mathematics, 26.06.2019 11:30

Chemistry, 26.06.2019 11:30

Geography, 26.06.2019 11:30

Mathematics, 26.06.2019 11:30

Mathematics, 26.06.2019 11:30