Business, 25.10.2019 19:43 alexiaaaa234

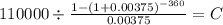

You have just signed a contract to purchase your dream house. the price is $140,000 and you have applied for a $110,000, 30-year, 4.5 percent loan. annual property taxes are expected to be $2,100. hazard insurance will cost $600 per year. your car payment is $450, with 36 months left. your monthly gross income is $4,000. calculate the total obligations (back-end) ratio.

Answers: 3

Another question on Business

Business, 21.06.2019 22:40

wilson's has 10,000 shares of common stock outstanding at a market price of $35 a share. the firm also has a bond issue outstanding with a total face value of $250,000 which is selling for 102 percent of face value. the cost of equity is 11 percent while the preminustax cost of debt is 8 percent. the firm has a beta of 1.1 and a tax rate of 34 percent. what is wilson's weighted average cost of capital?

Answers: 3

Business, 22.06.2019 11:30

Consider derek's budget information: materials to be used totals $64,750; direct labor totals $198,400; factory overhead totals $394,800; work in process inventory january 1, $189,100; and work in progress inventory on december 31, $197,600. what is the budgeted cost of goods manufactured for the year? a. $1,044,650 b. $649,450 c. $657,950 d. $197,600

Answers: 3

Business, 22.06.2019 11:30

On average, someone with a bachelor's degree is estimated to earn times more than someone with a high school diploma. a)1.2 b)1.4 c)1.6 d)1.8

Answers: 1

You know the right answer?

You have just signed a contract to purchase your dream house. the price is $140,000 and you have app...

Questions

Biology, 01.12.2020 19:50

English, 01.12.2020 19:50

English, 01.12.2020 19:50

Biology, 01.12.2020 19:50

Arts, 01.12.2020 19:50

Physics, 01.12.2020 19:50

Advanced Placement (AP), 01.12.2020 19:50

Law, 01.12.2020 19:50

Mathematics, 01.12.2020 19:50

Mathematics, 01.12.2020 19:50

History, 01.12.2020 19:50

Biology, 01.12.2020 19:50