Business, 25.10.2019 22:43 brooke012002

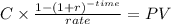

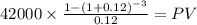

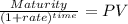

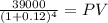

Brewster's is considering a project with a life of 5 years and an initial cost of $120,000. the discount rate for the project is 12 percent. the firm expects to sell 2,100 units a year at a net cash flow per unit of $20. the firm will have the option to abandon this project after three years at which time it could sell the project for $50,000. the firm is interested in knowing how the project will perform if the sales forecasts for years 4 and 5 of the project are revised such that there is a 50 percent chance the sales will be either 1,400 or 2,500 units a year. what is the net present value of this project given these revised sales forecasts? select one: a. $23,617b. $23,719c. $25,002d. $26,877e. $28,745

Answers: 3

Another question on Business

Business, 21.06.2019 19:40

Policymakers are provided data about the private and social benefits of a good being sold in the market. quantity private mb ($) social mb ($) 6 6 9 7 4 7 8 2 5 9 0 3 what is the size of the externality? if the externality is positive, enter a positive number. if negative, make it a negative number. $ given this data, policymakers must decide whether to address the associated externality with a subsidy or a tax. as their economic consultant, which of the two policy tools would you recommend? a subsidy a tax

Answers: 2

Business, 22.06.2019 01:30

How will firms solve the problem of an economic surplus a. decrease prices to the market equilibrium price b. decrease prices so they are below the market equilibrium price c.increase prices

Answers: 3

Business, 22.06.2019 18:00

Martha entered into a contract with terry, an art dealer. according to the contract, terry was to supply 18 th century artifacts to martha for the play she was directing, and martha was ready to pay $50,000 for this. another director needed the same artifacts and was ready to pay $60,000. terry decided not to sell the artifacts to martha. in this case, the court may order terry to:

Answers: 2

Business, 23.06.2019 02:30

Suppose a starbucks tall latte cost $4.00 in the united states, 5.00 euros in the euro area and $2.50 australian dollars in australia. nominal exchange rates are .80 euros per dollar and 1.4 australian dollars per u.s. dollar. where does purchasing power parity hold? a. both the euro area and australia. b. neither the euro area or australia. c. the euro area but not australia. d. australia but not the euro area.

Answers: 1

You know the right answer?

Brewster's is considering a project with a life of 5 years and an initial cost of $120,000. the disc...

Questions

Mathematics, 24.02.2021 20:00

English, 24.02.2021 20:00

English, 24.02.2021 20:00

Mathematics, 24.02.2021 20:00

Mathematics, 24.02.2021 20:00

Mathematics, 24.02.2021 20:00