Business, 26.10.2019 00:43 JohnBranks3258

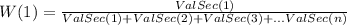

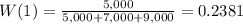

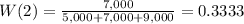

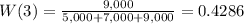

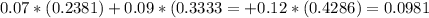

Security $ invested expected return 1 $5,000 7% 2 $7,000 9% 3 $9,000 12% give the data above: what is the weight of security 1? (show your work. label %. one decimal place required. highlight or bold your answer.) what is the weight of security 2? (show your work. label %. one decimal place required. highlight or bold your answer.) what is the weight of security 3? (show your work. label %. one decimal place required. highlight or bold your answer.) what is the expected return on the portfolio? (show your work. label %. two decimal places required. highlight or bold your answer.)

Answers: 1

Another question on Business

Business, 22.06.2019 09:40

As related to a company completing the purchase to pay process, is there an accounting journal entry "behind the scenes" when xyz company pays for the goods within 10 days of the invoice (gross method is used for discounts and terms are 2/10 net 30) that updates the general ledger?

Answers: 3

Business, 22.06.2019 16:40

Determine the hrm’s role in the performance management process and explain how to ensure the process aligns with the organization’s strategic plan.

Answers: 1

Business, 22.06.2019 20:00

Which of the following statements is true of the balanced-scorecard? a. it is a more or less a one-dimensional metric of measuring competitive advantages of a firm. b. it is one of the traditional approaches of measuring firm performance. c. its primary focus is to base a firm's strategic goals entirely on external performance dimensions. d. it attempts to provide a holistic perspective on firm performance.

Answers: 1

Business, 22.06.2019 23:00

Type of deposit reserve requirementcheckable deposits $7.8 - 48.3 million 3%over $48.3 million 10noncheckable personal savings and time deposits 0refer to the accompanying table. if a bank has $60 million in savings deposits and $40 million in checkable deposits, then its required reserves are$1.2 million.

Answers: 1

You know the right answer?

Security $ invested expected return 1 $5,000 7% 2 $7,000 9% 3 $9,000 12% give the data above: what...

Questions

Advanced Placement (AP), 29.07.2019 01:30

Mathematics, 29.07.2019 01:30

History, 29.07.2019 01:30