Business, 26.10.2019 04:43 mauricio18s

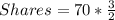

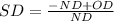

Assume that you own 70 shares of common stock of a company, that you have been receiving cash dividends of $3 per share per year, and that the company has a 3-for-2 stock split. required: how many shares of common stock will you own after the stock split? what new cash dividend per share amount will result in the same total dividend income as you received before the stock split? (do not round intermediate calculations. round your answer to 2 decimal places.)what stock dividend percentage could have accomplished the same end result as the 3-for-2 stock split?

Answers: 2

Another question on Business

Business, 22.06.2019 02:20

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 02:20

Archangel manufacturing calculated a predetermined overhead allocation rate at the beginning of the year based on a percentage of direct labor costs. the production details for the year are given below. calculate the manufacturing overhead allocation rate for the year based on the above data. (round your final answer to two decimal places.) a) 42.42% b) 257.14% c) 235.71% d) 1, 206.90% archangel production details.

Answers: 3

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 18:00

When peter metcalf describes black diamond’s manufacturing facility in china as a “greenfield project,” he means that partnered with a chinese company to buy the plant . of all market entry strategies, this one carries the lowest risk. because black diamond manufactures its outdoor sports products outside the united states, what risks must its managers be aware of?

Answers: 1

You know the right answer?

Assume that you own 70 shares of common stock of a company, that you have been receiving cash divide...

Questions

Mathematics, 02.12.2020 22:40

Mathematics, 02.12.2020 22:40

History, 02.12.2020 22:40

History, 02.12.2020 22:40

Mathematics, 02.12.2020 22:40

English, 02.12.2020 22:40

Spanish, 02.12.2020 22:40

Mathematics, 02.12.2020 22:40

Mathematics, 02.12.2020 22:40

History, 02.12.2020 22:40

Mathematics, 02.12.2020 22:40

History, 02.12.2020 22:40

Computers and Technology, 02.12.2020 22:40