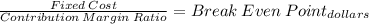

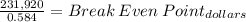

Gold star rice, ltd., of thailand exports thai rice throughout asia. the company grows three varieties of rice—white, fragrant, and loonzain. budgeted sales by product and in total for the coming month are shown below: product white fragrant loonzain total percentage of total sales 48 % 20 % 32 % 100 % sales $ 302,400 100 % $ 126,000 100 % $ 201,600 100 % $ 630,000 100 % variable expenses 90,720 30 % 100,800 80 % 110,880 55 % 302,400 48 % contribution margin $ 211,680 70 % $ 25,200 20 % $ 90,720 45 % 327,600 52 % fixed expenses 231,920 net operating income $ 95,680 dollar sales to break-even = fixed expenses = $231,920 = $446,000 cm ratio 0.52 as shown by these data, net operating income is budgeted at $95,680 for the month and the estimated break-even sales is $446,000. assume that actual sales for the month total $630,000 as planned. actual sales by product are: white, $201,600; fragrant, $252,000; and loonzain, $176,400.

required:

1. prepare a contribution format income statement for the month based on the actual sales data.

2. compute the break-even point in dollar sales for the month based on your actual data.

Answers: 2

Another question on Business

Business, 21.06.2019 22:30

Before contacting the news or print media about your business, what must you come up with first ? a. a media expertb. a big budgetc. a track recordd. a story angle

Answers: 1

Business, 22.06.2019 11:10

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 16:40

Determining effects of stock splits oracle corp has had the following stock splits since its inception. effective date split amount october 12, 2000 2 for 1 january 18, 2000 2 for 1 february 26, 1999 3 for 2 august 15, 1997 3 for 2 april 16, 1996 3 for 2 february 22, 1995 3 for 2 november 8, 1993 2 for 1 june 16,1989 2 for 1 december 21, 1987 2 for 1 march 9, 1987 2 for 1 a. if the par value of oracle shares was originally $2, what would oracle corp. report as par value per share on its 2015 balance sheet? compute the revised par value after each stock split. round answers to three decimal places.

Answers: 1

Business, 23.06.2019 00:00

According to the video, the gross national product had declined from $104 billion in 1929 to about in 1933.

Answers: 2

You know the right answer?

Gold star rice, ltd., of thailand exports thai rice throughout asia. the company grows three varieti...

Questions

Mathematics, 22.01.2020 06:32

Social Studies, 22.01.2020 06:32

Physics, 22.01.2020 06:32

Social Studies, 22.01.2020 06:32

Business, 22.01.2020 06:32

Biology, 22.01.2020 06:32

Biology, 22.01.2020 06:32