Business, 02.11.2019 05:31 PerfectMagZ

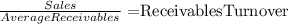

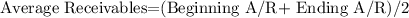

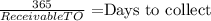

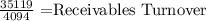

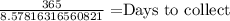

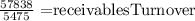

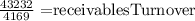

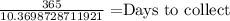

Analyzing allowance for doubtful accounts, receivables turnover ratio, and days to collect [lo 8-4]coca-cola and pepsico are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. to evaluate their ability to collect on credit sales, consider the following information reported in their 2010, 2009, and 2008 annual reports (amounts in millions).coca-colapepsico fiscal year ended: 2010 2009 2008 2010 2009 2008 net sales $ 35,119 $ 30,990 $ 31,944 $ 57,838 $ 43,232 $ 43,251 accounts receivable 4,478 3,813 3,141 6,467 4,714 3,784 allowance for doubtful accounts 48 55 51 144 90 70 accounts receivable, net of allowance 4,430 3,758 3,090 6,323 4,624 3,714 required: 1. calculate the receivables turnover ratios and days to collect for coca-cola and pepsico for 2010 and 2009. (use 365 days in a year. do not round intermediate calculations on accounts receivable turnover ratio. round your final answers to 1 decimal place. use final rounded answers from accounts receivable turnover ratio for days to collect ratio calculation.)

Answers: 1

Another question on Business

Business, 22.06.2019 04:30

Georgia's gross pay was 35,600 this year she is to pay a federal income tax of 16% how much should georgia pay in federal income ax this year

Answers: 1

Business, 22.06.2019 13:10

A4-year project has an annual operating cash flow of $59,000. at the beginning of the project, $5,000 in net working capital was required, which will be recovered at the end of the project. the firm also spent $23,900 on equipment to start the project. this equipment will have a book value of $5,260 at the end of the project, but can be sold for $6,120. the tax rate is 35 percent. what is the year 4 cash flow?

Answers: 2

Business, 22.06.2019 23:30

What is the difference between career options in the law enforcement pathway and career options in the correction services pathway?

Answers: 1

Business, 22.06.2019 23:50

Analyzing operational changes operating results for department b of delta company during 2016 are as follows: sales $540,000 cost of goods sold 378,000 gross profit 162,000 direct expenses 120,000 common expenses 66,000 total expenses 186,000 net loss $(24,000) suppose that department b could increase physical volume of product sold by 10% if it spent an additional $18,000 on advertising while leaving selling prices unchanged. what effect would this have on the department's net income or net loss? (ignore income tax in your calculations.) use a negative sign to indicate a net loss answer; otherwise do not use negative signs with your answers. sales $answer cost of goods sold answer gross profit answer direct expenses answer common expenses answer total expenses answer net income (loss) $answer

Answers: 1

You know the right answer?

Analyzing allowance for doubtful accounts, receivables turnover ratio, and days to collect [lo 8-4]c...

Questions

History, 18.03.2020 19:17

Computers and Technology, 18.03.2020 19:18

Mathematics, 18.03.2020 19:18

Social Studies, 18.03.2020 19:18

History, 18.03.2020 19:19

Social Studies, 18.03.2020 19:19

Mathematics, 18.03.2020 19:19

English, 18.03.2020 19:19