Business, 05.11.2019 02:31 itaheart101

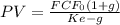

Justus motor co. has a wacc of 11.50%, and its value of operations is $25.00 million. justus's free cash flow is expected to grow at a constant rate of 7.00%. what was the last free cash flow, fcf0 in millions? a. $0.95b. $1.05c. $1.16d. $1.27e. $1.40

Answers: 3

Another question on Business

Business, 21.06.2019 22:10

There are more than two types of bachelors’ degrees true or false?

Answers: 1

Business, 22.06.2019 11:00

T-comm makes a variety of products. it is organized in two divisions, north and south. the managers for each division are paid, in part, based on the financial performance of their divisions. the south division normally sells to outside customers but, on occasion, also sells to the north division. when it does, corporate policy states that the price must be cost plus 20 percent to ensure a "fair" return to the selling division. south received an order from north for 300 units. south's planned output for the year had been 1,200 units before north's order. south's capacity is 1,500 units per year. the costs for producing those 1,200 units follow

Answers: 1

Business, 22.06.2019 12:10

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

Business, 22.06.2019 13:20

Last year, johnson mills had annual revenue of $37,800, cost of goods sold of $23,200, and administrative expenses of $6,300. the firm paid $700 in dividends and had a tax rate of 35 percent. the firm added $2,810 to retained earnings. the firm had no long-term debt. what was the depreciation expense?

Answers: 2

You know the right answer?

Justus motor co. has a wacc of 11.50%, and its value of operations is $25.00 million. justus's free...

Questions

History, 22.09.2019 00:00

Mathematics, 22.09.2019 00:00

World Languages, 22.09.2019 00:00

Biology, 22.09.2019 00:00

English, 22.09.2019 00:00

Social Studies, 22.09.2019 00:00

English, 22.09.2019 00:00

Mathematics, 22.09.2019 00:00

= 11.50% = 0.1150

= 11.50% = 0.1150