Business, 05.11.2019 02:31 makaylahunt

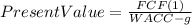

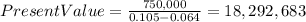

Acompany is expected to have free cash flows of $0.75 million next year. the weighted average cost of capital is wacc = 10.5%, and the expected constant growth rate is g = 6.4%. the company has $2 million in short-term investments, $2 million in debt, and 1 million shares. what is the stock's current intrinsic stock price? a. $17.39b. $17.84c. $18.29d. $18.75e. $19.22

Answers: 2

Another question on Business

Business, 22.06.2019 10:20

Blue spruce corp. has the following transactions during august of the current year. aug. 1 issues shares of common stock to investors in exchange for $10,170. 4 pays insurance in advance for 3 months, $1,720. 16 receives $710 from clients for services rendered. 27 pays the secretary $740 salary. indicate the basic analysis and the debit-credit analysis.

Answers: 1

Business, 22.06.2019 11:10

Use the following account numbers and corresponding account titles to answer the following question. account no. account title (1) cash (2) merchandise inventory (3) cost of goods sold (4) transportation-out (5) dividends (6) common stock (7) selling expense (8) loss on the sale of land (9) sales which accounts would appear on the income statement?

Answers: 3

Business, 22.06.2019 17:00

During which of the following phases of the business cycle does the real gdp fall? a. trough b. expansion c. contraction d. peak

Answers: 2

Business, 22.06.2019 17:50

The management of a supermarket wants to adopt a new promotional policy of giving a free gift to every customer who spends > a certain amount per visit at this supermarket. the expectation of the management is that after this promotional policy is advertised, the expenditures for all customers at this supermarket will be normally distributed with a mean of $95 and a standard deviation of $20. if the management wants to give free gifts to at most 10% of the customers, what should the amount be above which a customer would receive a free gift?

Answers: 1

You know the right answer?

Acompany is expected to have free cash flows of $0.75 million next year. the weighted average cost o...

Questions

Biology, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Chemistry, 10.11.2020 22:50

Biology, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50

History, 10.11.2020 22:50

Mathematics, 10.11.2020 22:50