Business, 05.11.2019 03:31 estefaniapenalo

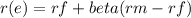

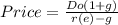

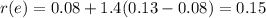

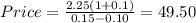

Assume that the risk-free rate is 8 percent, the expected return on the market is 13 percent, and that a share of stock in your company has a beta of 1.4. if the current dividend just paid (d0) was $2.25 and is expected to grow at a long-run growth rate of 10 percent per year, then how much should investors be willing to pay for this stock? group of answer choices

Answers: 2

Another question on Business

Business, 22.06.2019 19:00

In north korea, a farmer’s income is the same as a dentist’s income. in a country with a mixed or market economy, the difference between those two professions might be more than 5 times different. how can you explain the fact that individuals doing the same work in different countries do not earn comparable salaries?

Answers: 1

Business, 22.06.2019 22:50

Which of these makes a student loan different from other types of loans

Answers: 1

You know the right answer?

Assume that the risk-free rate is 8 percent, the expected return on the market is 13 percent, and th...

Questions

Mathematics, 25.05.2020 03:58

Mathematics, 25.05.2020 03:58

Mathematics, 25.05.2020 03:58

Biology, 25.05.2020 03:58

English, 25.05.2020 03:58

Mathematics, 25.05.2020 03:58

Mathematics, 25.05.2020 03:58

Mathematics, 25.05.2020 03:58

English, 25.05.2020 03:58

Mathematics, 25.05.2020 03:58

Physics, 25.05.2020 03:58

Mathematics, 25.05.2020 03:59

English, 25.05.2020 03:59

Mathematics, 25.05.2020 03:59