Business, 05.11.2019 03:31 rameseshajj

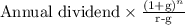

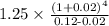

Wilbert's clothing stores just paid a $1.25 annual dividend. the company has a policy whereby the dividend increases by 2% annually. you would like to purchase 100 shares of stock in this firm but realize that you will not have the funds to do so for another three years. if you desire a 12% rate of return, how much should you expect to pay for 100 shares when you can afford to buy this stock? ignore trading costs.

a. $1,040

b. $1,160

c. $1,353

d. $1,766

e. $1,810

Answers: 1

Another question on Business

Business, 22.06.2019 03:00

Fanning books buys books and magazines directly from publishers and distributes them to grocery stores. the wholesaler expects to purchase the following inventory: april may june required purchases (on account) $ 111,000 $ 131,000 $ 143,000 fanning books accountant prepared the following schedule of cash payments for inventory purchases. fanning books suppliers require that 85 percent of purchases on account be paid in the month of purchase; the remaining 15 percent are paid in the month following the month of purchase. required complete the schedule of cash payments for inventory purchases by filling in the missing amounts. determine the amount of accounts payable the company will report on its pro forma balance sheet at the end of the second quarter.

Answers: 2

Business, 22.06.2019 04:50

Neveready flashlights inc. needs $317,000 to take a cash discount of 3/15, net 70. a banker will loan the money for 55 days at an interest cost of $13,200. a. what is the effective rate on the bank loan? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) b. how much would it cost (in percentage terms) if the firm did not take the cash discount but paid the bill in 70 days instead of 15 days? (use a 360-day year. do not round intermediate calculations. input your answer as a percent rounded to 2 decimal places.) c. should the firm borrow the money to take the discount? no yes d. if the banker requires a 20 percent compensating balance, how much must the firm borrow to end up with the $317,000? e-1. what would be the effective interest rate in part d if the interest charge for 55 days were $7,200?

Answers: 3

Business, 22.06.2019 05:30

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 21:10

Match the terms with their correct definition. terms: 1. accounts receivable 2. other receivables 3 debtor 4. notes receivable 5. maturity date 6. creditor definitions: a. the party to a credit transaction who takes on an obligation/payable. b. the party who receives a receivable and will collect cash in the future. c. a written promise to pay a specified amount of money at a particular future date. d. the date when the note receivable is due. e. a miscellaneous category that includes any other type of receivable where there is a right to receive cash in the future. f. the right to receive cash in the future from customers for goods sold or for services performed.

Answers: 1

You know the right answer?

Wilbert's clothing stores just paid a $1.25 annual dividend. the company has a policy whereby the di...

Questions

Mathematics, 14.01.2021 18:30

Mathematics, 14.01.2021 18:30

English, 14.01.2021 18:30

English, 14.01.2021 18:30

Mathematics, 14.01.2021 18:30

English, 14.01.2021 18:30

Mathematics, 14.01.2021 18:30

Mathematics, 14.01.2021 18:30

Spanish, 14.01.2021 18:30

Mathematics, 14.01.2021 18:30

Chemistry, 14.01.2021 18:30