Business, 06.11.2019 03:31 Gladistshiala267

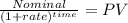

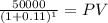

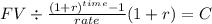

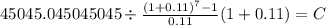

Suppose you need $50,000 ten years from now. you plan to make seven equal annual deposits with the first deposit to be made three years from today (e. g. t=3) in an account that yields 11% compounded annually. thus, your last deposit will be made at t=9. the money will remain in your account for one more year; it will continue to accrue interest, but you will not make at deposit at t=10. you will, however, withdraw $50,000 at that time. how much should each annual deposit be? (you might want to draw a time line to be sure you understand when the deposits are made.)

Answers: 1

Another question on Business

Business, 21.06.2019 18:20

James sebenius, in his harvard business review article: six habits of merely effective negotiators, identifies six mistakes that negotiators make that keep them from solving the right problem. identify which mistake is being described. striving for a “win-win” agreement results in differences being overlooked that may result in joint gains.

Answers: 2

Business, 22.06.2019 12:00

Describe the three different ways the argument section of a cover letter can be formatted

Answers: 1

Business, 22.06.2019 14:30

Stella company sells only two products, product a and product b. product a product b total selling price $50 $30 variable cost per unit $20 $10 total fixed costs $2,110,000 stella sells two units of product a for each unit it sells of product b. stella faces a tax rate of 40%. stella desires a net afterminustax income of $54,000. the breakeven point in units would be

Answers: 3

You know the right answer?

Suppose you need $50,000 ten years from now. you plan to make seven equal annual deposits with the f...

Questions

Biology, 21.04.2021 19:50

Mathematics, 21.04.2021 19:50

Mathematics, 21.04.2021 19:50

Mathematics, 21.04.2021 19:50

Mathematics, 21.04.2021 19:50

Mathematics, 21.04.2021 19:50