Business, 06.11.2019 21:31 hoolio4495

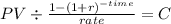

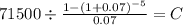

Prepare an amortization schedule for a five-year loan of $71,500. the interest rate is 7 percent per year, and the loan calls for equal annual payments. (do not round ntermediate calculations and round your answers to 2 decimal places, e. g. 32.16 leave no cells blank-be certain to enter "o" wherever required.) 35 beginning balance total payment how much interest is paid in the third year? (do not round intermediate calculations and round your answer to 2 decimal places, e-g.32.16) 70#81-ell] < prey next > 3 9

Answers: 3

Another question on Business

Business, 21.06.2019 21:30

In its 2016 annual report, caterpillar inc. reported the following (in millions): 2016 2015 sales $38,537 $47,011 cost of goods sold 28,309 33,546 as a percentage of sales, did caterpillar's gross profit increase or decrease during 2016? select one: a. gross profit increased from 26.8% to 28.6% b. gross profit decreased from 28.6% to 26.5% c. gross profit increased from 71.4% to 73.2% d. gross profit decreased from 73.2% to 71.4% e. there is not enough information to answer the question.

Answers: 2

Business, 22.06.2019 12:20

Bdj co. wants to issue new 22-year bonds for some much-needed expansion projects. the company currently has 9.2 percent coupon bonds on the market that sell for $1,132, make semiannual payments, have a $1,000 par value, and mature in 22 years. what coupon rate should the company set on its new bonds if it wants them to sell at par?

Answers: 3

Business, 22.06.2019 15:30

The school cafeteria can make pizza for approximately $0.30 a slice. the cost of kitchen use and cafeteria staff runs about $200 per day. the pizza den nearby will deliver whole pizzas for $9.00 each. the cafeteria staff cuts the pizza into eight slices and serves them in the usual cafeteria line. with no cooking duties, the staff can be reduced by half, for a fixed cost of $75 per day. should the school cafeteria make or buy its pizzas?

Answers: 3

Business, 22.06.2019 23:50

Melissa buys an iphone for $240 and gets consumer surplus of $160. a. what is her willingness to pay? b. if she had bought the iphone on sale for $180, what would her consumer surplus have been?

Answers: 3

You know the right answer?

Prepare an amortization schedule for a five-year loan of $71,500. the interest rate is 7 percent per...

Questions

Mathematics, 15.09.2019 02:10

Mathematics, 15.09.2019 02:10

Spanish, 15.09.2019 02:10

Mathematics, 15.09.2019 02:10

Biology, 15.09.2019 02:10

Social Studies, 15.09.2019 02:10

Mathematics, 15.09.2019 02:10