Business, 06.11.2019 22:31 nakarelinp0p303

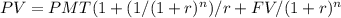

Assume that you are looking at an investment opportunity that offers an annual operating cash flow of $40,000 per year for 4 years. the initial investment to purchase the necessary equipment is $200,000. you assume that you can sell the equipment at the end of 4 years for $70,000. also, there is a need for an investment in net working capital of $15,000. if the required rate of return is 5%, and the tax rate is 35%, would you accept this project?

Answers: 2

Another question on Business

Business, 21.06.2019 13:00

The local electronics store is offering a promotion "1-year: same as cash," meaning that you can buy a tv now, and wait a year to pay (with no in

Answers: 1

Business, 22.06.2019 14:30

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 22.06.2019 19:00

15. chef a insists that roux is the traditional thickener for bisque. chef b insists that it's rice. which chef is correct? a. neither chef is correct. b. both chefs are correct. c. chef b is correct. d. chef a is correct.

Answers: 1

You know the right answer?

Assume that you are looking at an investment opportunity that offers an annual operating cash flow o...

Questions

English, 18.10.2020 15:01

Mathematics, 18.10.2020 15:01

Mathematics, 18.10.2020 15:01

Mathematics, 18.10.2020 15:01

Computers and Technology, 18.10.2020 15:01

English, 18.10.2020 15:01

Social Studies, 18.10.2020 15:01

Mathematics, 18.10.2020 15:01

Biology, 18.10.2020 15:01

History, 18.10.2020 15:01

History, 18.10.2020 15:01

Social Studies, 18.10.2020 15:01