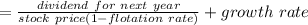

Builtrite’s common stock is currently selling for $48 a share and the firm just paid an annual dividend of $2.80 per share. management believes that dividends and earnings should grow at 8% annually. since new stock would need to be sold to finance an expansion, builtrite expects flotation costs to be 5% of the expected selling price of $48 a share. based on this, and a marginal tax rate of 34%, what is the cost of new common stock?

Answers: 2

Another question on Business

Business, 22.06.2019 22:40

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 2

Business, 22.06.2019 23:40

Robert is a district manager who oversees several store managers in a national chain of restaurants. robert reports directly to the vice president of stores and marketing, a member of top management. robert is a middle manager.t/f

Answers: 2

Business, 23.06.2019 00:30

Kim davis is in the 40 percent personal tax bracket. she is considering investing in hca(taxable) bonds that carry a 12 percent interest rate. what is her after- tax yield(interest rate) on the bonds?

Answers: 1

You know the right answer?

Builtrite’s common stock is currently selling for $48 a share and the firm just paid an annual divid...

Questions

Chemistry, 11.04.2021 01:10

Mathematics, 11.04.2021 01:10

English, 11.04.2021 01:10

Mathematics, 11.04.2021 01:10

Mathematics, 11.04.2021 01:10

Mathematics, 11.04.2021 01:10

Mathematics, 11.04.2021 01:10

History, 11.04.2021 01:10